Find out how to take advantage of current tax provisions before they potentially sunset at the end of 2025.

The Tax Cuts and Jobs Act of 2017 (TCJA) temporarily modified the U.S. federal tax code to reduce individual, corporate and estate tax rates through Dec. 31, 2025. While it’s likely that some or all of the TCJA provisions could be extended, talk to us and your tax professional about opportunities to take advantage of current law before pre-2017 brackets and higher tax rates resume in 2026.

Here are tax-savings strategies to consider before provisions sunset at the end of 2025:

What is the Tax Cuts and Jobs Act (TCJA)?

TCJA, which took effect on Jan. 1, 2018, includes extensive tax cuts that are set to expire at the end of 2025. While the legislation provides relief to most tax brackets, top-earning individuals and high-net-worth investors benefit most.

TCJA's top temporary provisions include:

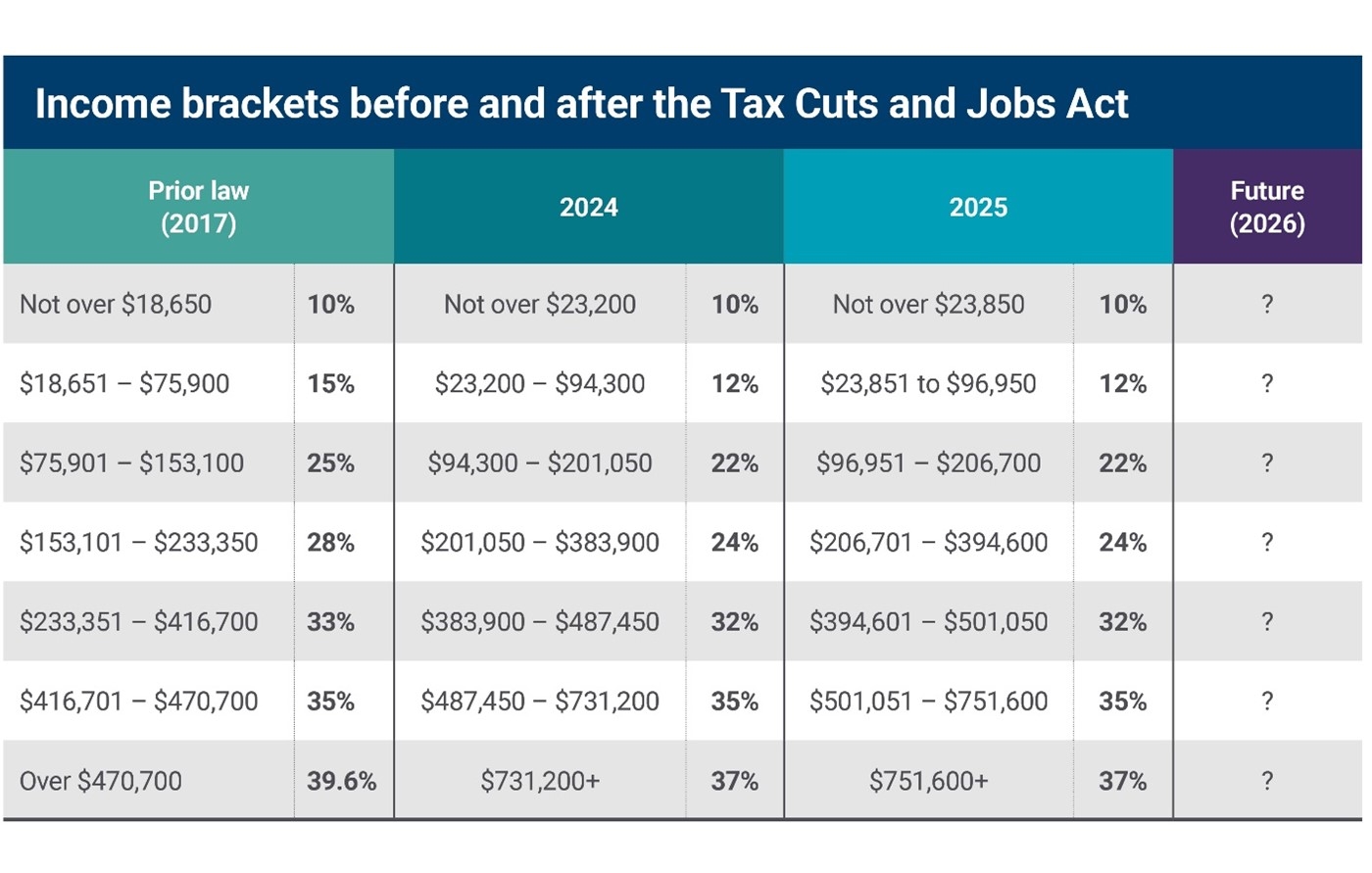

- Reduced tax rates, which were made possible by restructuring income tax brackets (see chart below).

- A higher lifetime estate and gift tax exemption, which more than doubled from $5.49 million for individuals in 2017 to $13.99 million in 2025, and is indexed to inflation.

- A higher standard deduction, which more than doubled for tax filers and is indexed to inflation. For example, those who filed as a married couple saw the standard deduction increase from $12,700 in 2017 to $30,000 in 2025.

The income brackets listed above assume a tax filer is married and filing jointly. Please note the income ranges from 2017 would be adjusted for inflation.

Strategies to consider before the TCJA expires

There’s still time to realize long-term benefits from the TCJA. While tax management is an important part of a holistic investment strategy and estate plan, it's just one component to consider when making such decisions.

1. Pay taxes now with a Roth IRA conversion, capital gains harvesting and other strategies

Since tax rates are lower currently, consider opportunities to pay certain income taxes now so you can potentially reduce tax payments later.

Strategies include:

- Roth IRA or Roth 401(k) conversion: Converting assets from pre-tax retirement accounts into a Roth IRA is a taxable event. As such, if you were to initiate a Roth IRA conversion before 2025, you’ll pay lower income taxes on those converted assets now, and benefit from tax-free distributions in retirement. If your 401(k) plan offers a Roth 401(k), you can also consider a similar conversion strategy.

- Contributing more to after-tax accounts: Similar to the strategy above, contributing more after-tax dollars to a Roth IRA or Roth 401(k) may also allow you to take advantage of today’s lower rates.

- Withdrawing more from pre-tax accounts: For retirees, it may make sense to take larger distributions from pre-tax accounts over the next couple years, while waiting to withdraw from your after-tax accounts in the years after the TCJA expires. Work with your financial advisor to strategically plan your withdrawals.

- Capital gains harvesting: With capital gains harvesting, you strategically sell assets and pay taxes on your gains when tax brackets are more favorable for you. Capital gains harvesting — which is essentially the inverse of tax-loss harvesting — is a complicated strategy, so work with your financial advisor and your tax professional to evaluate whether it may be advantageous to sell certain appreciated assets now, while the TCJA rates are still in effect.

Tax center

Find resources to help answer your tax-related questions.

Tax resources2. Reduce potential estate taxes by gifting or transferring assets

TCJA temporarily doubled the individual lifetime estate and gift tax exemption to $13.99 million in 2025, adjusted for inflation. If the TCJA sunsets as scheduled, those provisions will decline by approximately half for 2026.

This higher federal exclusion — combined with the lower tax rates — presents a unique opportunity to help manage state and federal estate taxes in the future. Here are a few ways to reduce the size of your estate — while benefiting loved ones and causes that are important to you:

- Lifetime giving: For 2025, federal law currently allows individuals to gift up to $19,000 per year (and $38,000 for a couple) to an unlimited number of individuals, tax-free. These gifts do not count toward your total federal lifetime gift and estate tax exemption.

- 529 plans: Under special rules, you can “superfund” these college savings plans with a one-time contribution of up to five times the annual gift tax exclusion amount (for a total of $95,000). You won’t incur a gift tax or affect your lifetime gift and estate tax exclusion. However, any gifts made to that same beneficiary over the next five years will require filing a gift tax return (unless the gift tax exclusion was increased, such as through an inflation adjustment in subsequent years).

- Special spousal rules: You can avoid estate taxes that might be due upon your passing by leaving your estate to your surviving spouse. Under the unlimited marital deduction, you can transfer any amount of money to a spouse while you’re still alive or at death. You won’t incur either federal gift or estate tax if you are both U.S. citizens.

- Charitable donations: TCJA also temporarily increased the cash donation deduction to public charities from 50% to 60% of adjusted gross income. Consider whether taking advantage of these increased limits can potentially help your tax situation and leave a meaningful legacy.

3. Delay deductible expenses to take advantage of a lower standard deduction in 2026

The TCJA also doubled the standard deduction from $12,700 in 2017 to $30,000 in 2025, making it less beneficial for tax filers to itemize their deductions. Barring legislation changes for 2026, the standard deduction will return to a lower amount, providing a unique opportunity for tax filers.

You may consider delaying certain deductible expenses, like elective medical procedures or certain charitable donations, until after 2026. This tax strategy, called "bunching," allows you to consolidate your deductible expenses in certain years for maximum itemizing benefits, while in other years, you take the standard deduction.

Consider your options before the TCJA expires

Reach out to us and your tax professional to identify TCJA strategies that can potentially help you manage the impact of taxes on your investments and estate.