Find out how to effectively manage cash flow to help you meet both your short-term needs and long-term goals.

“Cash flow” is a term often associated with business, but successfully managing cash is also a critical element of personal finances.

When you understand where your money is coming from, where it’s going and what you can do with the rest, it can help you stay on track toward achieving your financial goals. We can help you balance immediate cash flow needs with longer-term priorities.

Here are five steps to manage your cash flow:

In this article:

- Create a budget

- Save systematically

- Reduce debt outlays

- Keep a cash reserve for liquidity

- Make excess cash work for you

- Questions to discuss with us

1. Create a budget

Being smart about managing your cash starts with knowing how much money is coming in and going out of your household each month. This is where creating a household budget — also known as an expense management strategy — comes in.

Ultimately, a good budget should help you track your income, regulate your spending and prioritize saving so that you can stay on top of your cash flow. In the long run, you’ll also be able to identify bigger spending patterns and potential opportunities to save.

Learn more: Personal budgeting strategies to help you reach goals

2. Save systematically

Systematic saving is the process of automatically setting aside a specific amount of income toward your savings goals on a regular basis — and revisiting those strategies often to identify ways to save more toward your goals. This cash flow management strategy can help you prioritize putting money away because of the automated nature of the transaction and because your savings is treated as a fixed line item in your overall budget.

Many employees unintentionally use the systematic saving approach when they opt into their employer’s 401(k) plan. But it’s also a strategy that can easily be applied to your personal finances. A tried-and-true technique is to set up automatic withdrawals through your employer’s payroll system, your bank, credit union or brokerage firm.

Learn more: Personal budgeting strategies to help you reach your goals

3. Reduce debt outlays

Not all debt is bad, but too much can put a dent in your cash flow and make it harder to achieve your goals. If freeing up cash by reducing or eliminating debt is a priority, you can use several different strategies, like loan consolidation or the debt avalanche and snowball methods, to tackle your financial liabilities effectively.

Learn more: Strategies to help pay down debt faster

4. Keep a cash reserve for liquidity

A cash reserve is a critical part of cash flow management as it can help you cover the cost of an emergency or job loss without disrupting your ability to meet your other financial obligations. Generally, a healthy cash reserve should be 3-6 months of living expenses. However, that number may differ depending on your situation, life stage and the needs that could arise.

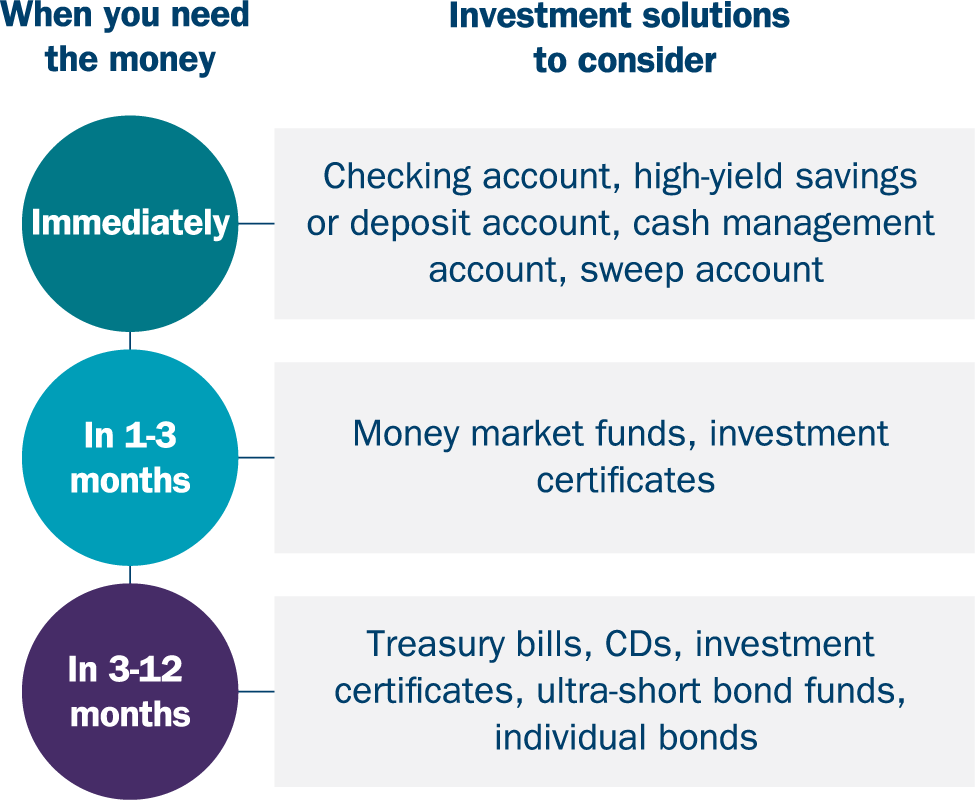

Importantly, a cash reserve should give you liquidity and keep up with inflation. To do that, consider a three-tiered structure for your emergency fund:

This example is for illustrative purposes only.

Learn more: Establishing a cash reserve: How much should you have?

5. Make excess cash work for you

Once you strike the right cash flow balance between your savings, spending and debt obligations, consider how to put surplus cash toward your financial goals. For example, you may consider contributing the maximum amount to your retirement accounts. Or you may decide to use excess cash to fund a new brokerage account or as a downpayment for a home. Whatever you decide, you’ll want to ensure that any remaining overflows are working for you and, at a minimum, are earning returns that outpace the rate of inflation.

We can help make your money work for you

We can help you make smart decisions when it comes to managing cash to help you achieve your short- and long-term goals.