Anthony Saglimbene, Chief Market Strategist – Ameriprise Financial

2024 may have been eventful for investors, but it’s also generated a lot of positive momentum for equity markets. As we end a year that’s been especially favorable to stock prices, here are our reflections on the last 12 months and how this backdrop may influence market dynamics in 2025.

A look back at 2024

The year started strong, with the S&P 500 Index finishing the first quarter on a high note, driven by a strong U.S. economic backdrop, moderating inflation pressures, improving profit conditions and expectations of rate cuts from the U.S. Federal Reserve. Investor enthusiasm around artificial intelligence (AI) also played a significant role, boosting both Big Tech and smaller companies associated with the theme.

That momentum continued through the second quarter, with the S&P 500 Index marking its strongest three-quarter run since mid-2021. By the end of June, stock volatility had reached some of its lowest levels since January 2020. Again, an AI boom helped drive substantial gains across information technology and communication services. However, elevated interest rates and a Federal Reserve on pause kept a lid on broader market gains.

Within fixed income, the 10-year U.S. Treasury yield rose in the first half of the year and return performance across major bond indexes was mixed. Through the first six months of the year, U.S. economic and profit growth remained firmly positive, core consumer inflation fell and the labor market remained solid.

Although stocks battled with bouts of volatility in July and August, the S&P 500 posted its best first nine months of the year (in an election year) going all the way back to 1950. Interestingly, the narrow leadership of Big Tech in the first half began to broaden in the third quarter, with a shift to cyclical and defensive areas outside of technology, including utilities, real estate, industrials and financials.

In September, the Fed lowered its policy rate for the first time since 2020, ending an aggressive rate-hiking cycle to combat inflation pressures and beginning a new monetary policy stance supportive of economic growth and the labor market. Since the September rate cut, the Fed has continued to ease rate policy and has suggested that the committee will take a gradual approach to normalizing monetary policy moving forward.

In November, U.S. voters elected former President Donald J. Trump to the White House for a second term, with full Republican control of Congress. Since the election, investors have reacted with guarded optimism to the prospects for potentially lower taxes and less regulation but remain concerned about the path forward for tariffs, immigration, and fiscal spending priorities.

Source: FactSet. This example is shown for illustrative purposes only and is not guaranteed. Past performance is not a guarantee of future results. An index is a statistical composite that is not managed. It is not possible to invest directly in an index.

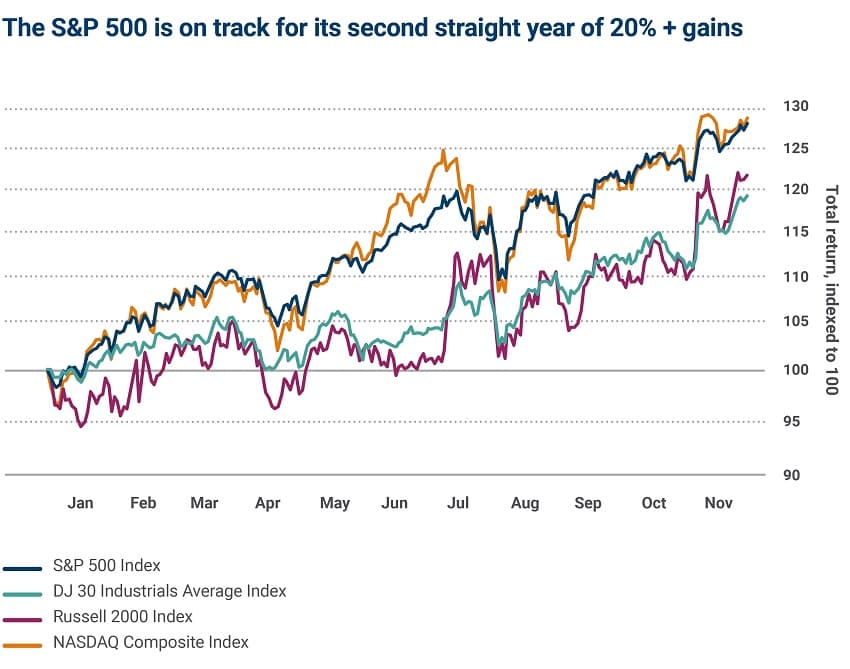

With an eventful year winding down, U.S. stocks are on pace to record another year of strong annual returns. In fact, the S&P 500 recorded its strongest month of performance this year in November, putting the index on pace for two consecutive years of back-to-back +20% plus returns for the first time since the late 1990s. Since the election, investors have favored small-cap stocks, financials, consumer discretionary and software companies while reducing exposure to health care, utilities and strategies that hedge volatility.

Notably, after a run higher from mid-September to mid-November, the 10-year U.S. Treasury yield has moved lower. Still above-normal inflation, strong growth trends and escalating debt/deficit concerns have buoyed longer-term government bond yields in the fourth quarter.

Will the 2024 market momentum carry into 2025?

Stocks experienced significant positive momentum in 2024. Ameriprise Financial Chief Market Strategist Anthony Saglimbene shares his insights on whether that trend may continue in 2025. (3:43)

A look ahead at 2025

Looking ahead, we see a favorable backdrop in 2025, but one that may require a more patient and disciplined investment approach. Firm economic conditions, near-normal inflation, broadening profit growth, strong secular themes across technology and growth-focused fiscal policies could see stocks finish the year higher than current levels, albeit with periods of volatility throughout 2025. However, we believe much of the optimism about next year is already priced into stocks, which leaves less upside room if conditions come in as expected and more downside risk if conditions come in worse than believed.

Investors should be prepared to weather occasional storms in 2025, which could leave the market environment more challenging to navigate compared to the relatively calm seas investors have enjoyed the last several months and, for that matter, most of 2024.

Overall, stock valuations across certain areas are elevated, interest rates remain high and there is a risk growth could slow more than expected next year if Fed or fiscal policies turn from tailwinds to headwinds. Although these points may seem obvious, after such strong gains in the S&P 500 over the last two years, we question if investors are prepared for a potential quarter or two of negative returns if the Goldilocks environment that's currently built into stock prices doesn't materialize the way the script is written.

Bottom line: Consider sticking to the basics in 2025. Continue to focus on a diversified investment approach, shade portfolios toward the U.S., incorporate strategies that focus on yield and be prepared for an eventful year ahead.

Start 2025 with the help of your Ameriprise financial advisor

Connect with your Ameriprise financial advisor if you’d like personalized insights on how the developments of the past year may affect your portfolio. They can help you make sense of the external environment, review your overall financial strategy and recommend actions that can help you start 2025 in a strong position.