Robert M. Almeida, Portfolio Manager and Global Investment Strategist – MFS Investment Management

4/21/2025

Capitalist economies allocate resources by pulling capital from industries with falling values and returns and investing it in industries with rising values and returns. This capital cycle can drive innovation, progress and change. However, cycles are imperfect, often moving through expansions and contractions.

Historically, investors flood high-return projects with capital, creating an expansion. At first, supply meets demand, but eventually, supply exceeds demand. Returns collapse, and the contraction is underway.

In 2024, many forecasts for a U.S. recession came up short, giving investors a renewed appetite for risk assets. However, that investor emphasis may be misplaced. Investing in industries with excess supply is a far greater risk to investors. Conversely, investments in industries with constrained supply and durable returns may offer better outcomes instead of trying to time markets based on economic and interest rate predictions.

Exploring an expansion

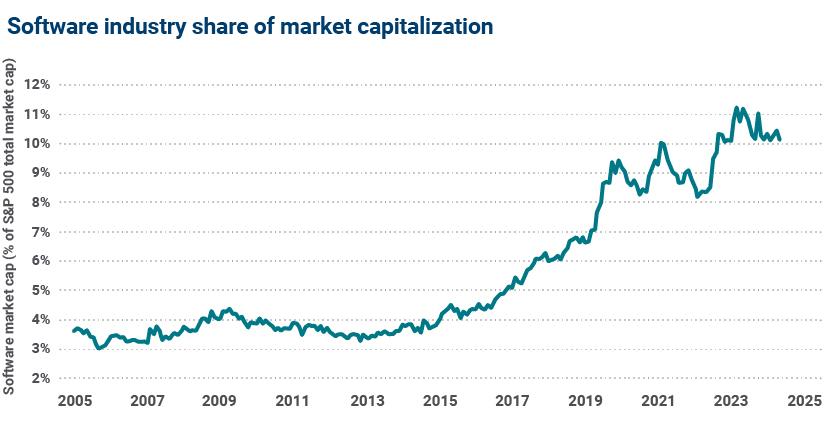

Following the 2008 global financial crisis, companies repurchased their stock, shifted manufacturing to China or purchased software. This resulted in the software industry doubling its share of the S&P 500 Index market capitalization.

Source: FactSet. Monthly data from 30 September 2005 to 31 January 2025. This chart is shown for illustrative purposes only.

Larger companies spent heavily and reaped the highest efficiency gains. Today, companies with more than 10,000 employees have on average, 650 software applications.

Yet, software spending has been in decline for the last couple of years. Why? In general, companies are digesting software, and AI is taking wallet share.

Technology is deflationary over time. Replacing an old technology with a new one provides cost savings and efficiency gains. When most people think of AI, they think of the benefits and positive impact to productivity. That’s true. But what about the revenues tied to the technology AI is replacing? Many of the companies in the chart above are facing collapsing returns.

Looking for the contraction

Many investors are following cues from economists and policy makers who use backward-looking models to predict future economic activity and interest rates. We believe they may be looking in the wrong place: The next contraction won’t likely come from where the last contraction was; it will likely come from where the expansion was.

The expansion wasn’t in GDP, the labor market or household spending. The expansion was in software. And while that expansion was justified by attractive returns and efficiencies for companies, AI can potentially do more at a fraction of the cost.

Bottom line

We expect IT budgets will shift from software to AI. While the software industry is saturated with too much competition, AI may not be able to duplicate mission-critical software. Avoiding challenged companies while owning mission-critical software providers may prove a powerful recipe for performance.

Questions about your investment strategy?

If you have questions about your investments, connect with your Ameriprise financial advisor to help evaluate potential opportunities in alignment with your overall financial strategy and goals.