Know your options when it comes to managing this major expense in your retirement years.

Health care continues to be one of the most significant expenses retirees face. Yet determining how much is needed can be unclear as health care costs for retirees depend on various factors, including income, age, fitness, location and life expectancy. Further, Medicare — while a valuable program for many — can be complicated to navigate.

As you transition to retirement, we can help you prepare, from providing guidance on Medicare enrollment to planning for the potential of long-term care.

Here’s how to plan for health care costs in retirement:

In this article:

- Estimate how much you’ll need

- Know how your retirement age affects your options

- Understand how your income impacts your Medicare costs

- Anticipate long-term care needs

- Questions to discuss with us

1. Estimate how much you’ll need

Health care costs in retirement can be substantial, even with Medicare. Everyday medical expenses such as drug prescriptions and routine medical services can add up over time. In fact, according to the Employee Benefit Research Institute, a 65-year-old man will need to save $166,000 to have a 90 percent chance of having enough money to cover Medicare premiums and prescription drug costs in retirement. A 65-year-old woman will need even more: $197,000.1

These expenses can be even more significant for those with more complicated needs. It also doesn’t factor in long-term care costs, which Medicare generally doesn’t cover and can be exceptionally expensive. As you consider your retirement, it’s important to estimate all your health care costs for the years ahead.

2. Know how your retirement age affects your options

Though age 65 has long been synonymous with retirement, not everyone retires then. Here’s how your retirement age can impact your health care access:

If you retire before 65

If you decide to retire before you turn 65, you’ll likely need health care coverage that bridges the gap until you’re eligible for Medicare. There are multiple avenues to explore: you could potentially join your spouse’s health plan, buy coverage through the public marketplace or a private broker or explore whether you’re eligible for COBRA coverage. There is no one “right” option for retirees in this interim period, so you’ll want to compare coverage details and determine what may work for your situation.

Minding the gap: What to do when facing the loss of health coverage

Find out how to address your health care needs in the event you retire early, you lose coverage or are dissatisfied with your current plan.

Learn more

If you retire at 65:

For most people, Medicare is the primary way to obtain health care once they are eligible. The federal health insurance program consists of several parts, each covering different health-related expenses.

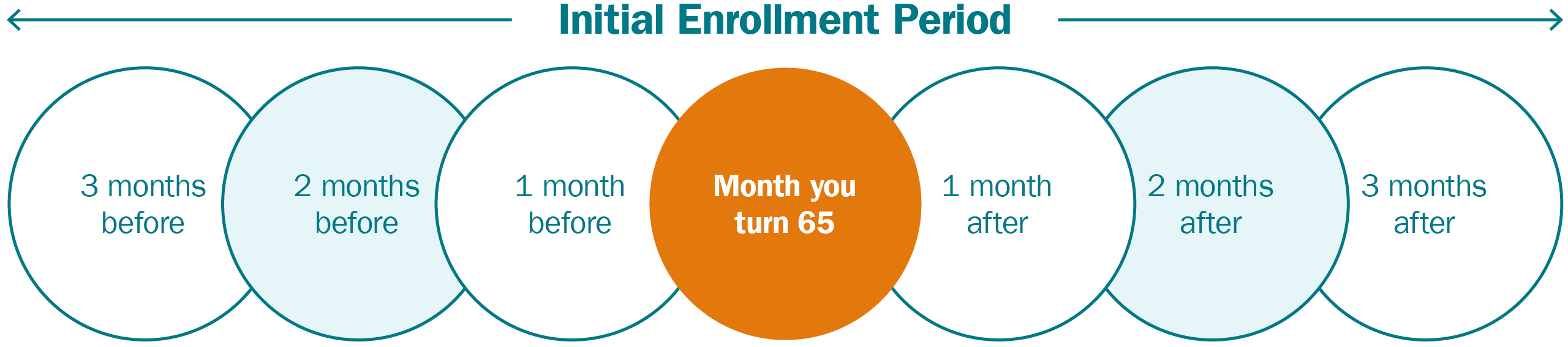

In the year leading up to your 65th birthday, you’ll want to understand how Medicare works, how to enroll and other costs and considerations associated with the program. The program comes with many nuances, so being well-versed is key to making the best decisions for your health.

If you continue to work past 65

If you work past age 65 and have health insurance through an employer or a spouse’s employer, you have a choice:

- You can choose to stay on your health plan without incurring any late-enrollment penalties from Medicare. If you continue to work, you will qualify for a Special Enrollment Period, which lets you enroll in Part A (the premiums are $0 for most people) when you turn 65 but decline Part B and “re-enroll” later without any penalties. Ask your employer’s human resources department if you need to sign up for Medicare when you turn 65, as some plans don't cover the costs of your medical services after age 65.

- You can choose to enroll in Medicare. Compare your employer-sponsored plan with what you could receive with Medicare, including any supplemental coverage and prescription drug benefits.

Learn more: How to sign up for Medicare the first time: a step-by-step guide

3. Understand how your income impacts your Medicare costs

Medicare isn’t free, and what you pay will vary substantially depending on your income.

If your modified adjusted gross income exceeds certain thresholds, you’re required to pay a surcharge on top of the standard premium for Original Medicare. The surcharge, known as the Income Related Monthly Adjustment Amount (IRMAA), kicks in when your modified adjusted gross income (MAGI) is above a certain threshold, which is updated every year. The IRMAA surcharge can significantly increase the amount you’re required to pay for your monthly premiums and prescription drug plans. Deductibles and copays may also apply depending on the plan you select.

Learn more about Medicare premiums and surcharges in our guide to Medicare.

4. Anticipate long-term care needs

While long-term care costs vary widely by region and type of facility, they are significant and only expected to rise in the coming years. Yet health insurance does not pay for daily, extended-care services, and Medicare and Medigap policies offer limited coverage for long-term care.

One way to plan for these costs is to purchase long-term care insurance, either through a stand-alone policy, a hybrid policy or a long-term-care rider attached to a life insurance policy. While premiums for such coverages vary, they are generally based on age, health status and the level of benefit you select.

Feel more confident about your health coverage in retirement

We can help you understand the many nuances of Medicare and how to plan for your health care expenses so that you can enjoy your retirement.