Understand where you are in your financial journey so you can plan to reach your goals.

No matter your financial goals — buying a house, saving for a child’s education, planning for retirement — the first step to reaching them is getting a good sense of your current financial picture.

We will assess your financial situation and unique needs as part of a strategy to help you reach your short-, medium- and long-term goals. To get you started, here are steps to help you evaluate your overall financial health:

In this article

- Define and document your goals

- Review and organize your financial records

- Calculate your net worth

- Determine your debt-to-income ratio

- Understand how you’re spending money

- Start investing as soon as you can

- Questions to discuss with us

1. Define and document your goals

What do you want to achieve? As part of your financial health check, write down your short-, medium- and long-term financial goals, such as paying for a home or wedding, paying off debts or building wealth for a comfortable retirement.

Once you establish your goals, prioritize them based on their significance and urgency so that you have something tangible to work toward. Tracking progress toward your goals can help you make more strategic decisions over time about how you choose to spend, save and invest.

We will review your financial goals with you and record your progress toward your goals online, so that you can review them anytime, anywhere, from any device.

2. Review and organize your financial records

Regularly reviewing and organizing your bank statements, tax forms, pay stubs, invoices and other financial records can provide clarity about your current financial situation. You’ll not only get a sense of control over your finances, but a sense of security knowing that if an emergency arises, you can access specific documents easily.

There are many different systems and methods to help you organize, retain and dispose of important financial documents. The Ameriprise secure site, for example, allows you to store and share documents, see your entire financial picture in one place and includes security measures such as alerts.

Learn more: How to keep your financial records organized

3. Calculate your net worth

Your net worth is a vital financial metric that provides a snapshot of where you are in your journey of building wealth.

To calculate your net worth, subtract the value of your liabilities (including credit card debt, student loans and the balance of your mortgage) from the value of all your assets (including cash, investments and the value of your home). As you accumulate assets and pay off debt you may have, tracking your net worth over time allows you to see how you are progressing toward your goals.

Learn more: How to track and help grow your net worth

4. Determine your debt-to-income ratio

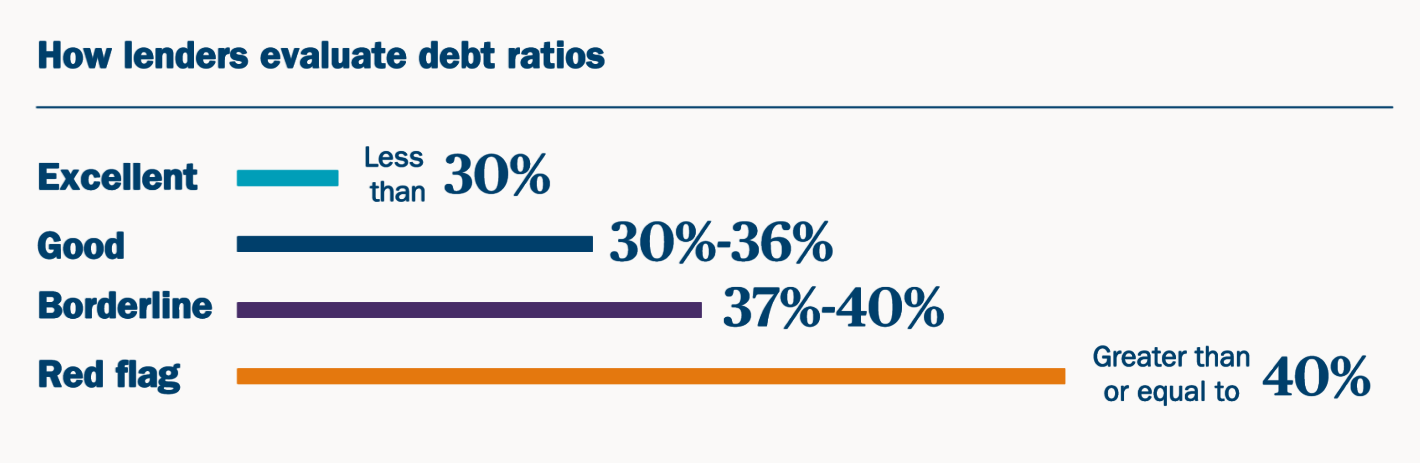

Your debt-to-income ratio is used by lenders to measure your ability to manage monthly payments and repay debts. It’s also a significant factor in determining your credit score. Knowing this number can be especially important when purchasing a home or taking on loans.

You can calculate your ratio by dividing your monthly debt payments by your monthly gross income. While there is no “correct” debt-to-income number — in fact, it is likely to fluctuate throughout your financial life — the lower the number is, the less risky you’re considered as a borrower.

Here are some general guidelines for how lenders look at debt-to-income ratios:

Learn more: Credit scores, explained: A guide to understanding your credit score

5. Understand how you’re spending money

Whatever stage of life you’re in, managing expenses is critical. “Lifestyle creep” and increased spending can make it harder to reach your financial goals.

Creating an expense management strategy for your household can help you balance life’s many priorities. Whatever method you choose, however, the objectives will be similar:

- Cover current needs within your budget.

- Manage debts.

- Build a cash reserve for emergencies.

- Save for your goals.

6. Start investing as soon as you can

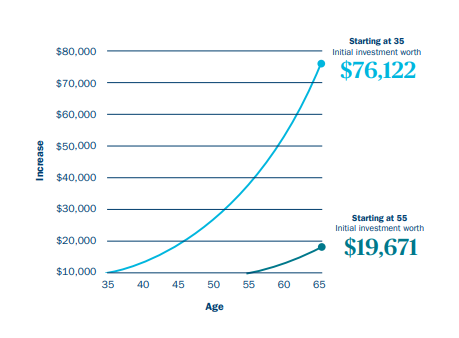

Investing offers the potential of growing your money to keep pace with inflation and to achieve long-term financial goals. While every investment strategy is unique to an individual’s objectives, risk tolerance and time horizon, there is one universal principle that applies to all investors: Time is on your side, especially if you start early.

History shows that the sooner you start investing, the more time your money has to grow. By investing early, you allow the combination of time and the power of compounding returns to work.

How the power of compounding can increase returns

This illustration is based on an initial investment and 7% annual growth per year. It is a hypothetical illustration and is meant to show the effects of compounding returns. It is not meant to represent any specific investment or imply any guaranteed rate of return and does not account for inflation, taxes, sales charges, or other expenses that may be required for some investments.

To see how your investment could grow over time, check out our investment returns calculator.

Investment returns calculator

Use this calculator to gain a better understanding of how different inputs can impact the rate of return on your investments.

Calculate your potential returns

Let’s evaluate your financial health

We will help you understand your current financial situation and help you stay on track toward your financial goals.