Belinda Boa, Head of Active Investments for Asia Pacific – BlackRock

Japanese stocks were standout performers in 2023 and into the first half of 2024, following years of stagnation and deflation that left Japan as an unloved investment destination. Can the positive momentum continue, despite the recent volatility?

Here’s why Japan may have the makings of a fairytale revival with staying power — and abundant investment potential.

Riches to rags … to riches again?

Japan was the picture of success in the mid-20th century. Its status as a rich agricultural hub in the 1960s and a center of engineering and innovation in the 1970s helped propel Japan to become the world’s second-largest economy by the 1980s. Economic success begot market success, and at its peak in December 1989, Japan represented 45% of the world’s stock market capitalization.1

Few may recall this bygone Japan, as what followed was three decades of economic stagnation and deflation that sent the country’s market cap on a steep decline — to roughly 6% today.2 Yet this number has been inching higher, particularly as Japan led global stock market gains in 2023 and continued its positive momentum into 2024. This thrust may be able to continue amid what we believe is a massive transformation.

Supportive shifts afoot

There are several shifts that are bringing real enthusiasm — and real money — back to the long unloved market:

1. Economic rewiring

After decades in a deflationary spiral, inflation is coming back. This will likely have a profound impact on households and corporations that previously had little incentive to invest amid persistent economic weakness. Now, instead of hoarding cash and worrying about costs, the return of inflation means companies will be able to increase prices, leading to margin expansion and enhanced profitability.

2. A global diversifier

Not only is Japan’s policy position different from the rest of the world, which has been in an inflationary environment with expectations for higher-for-longer interest rates, but the Japanese stock market also is a diversification play.

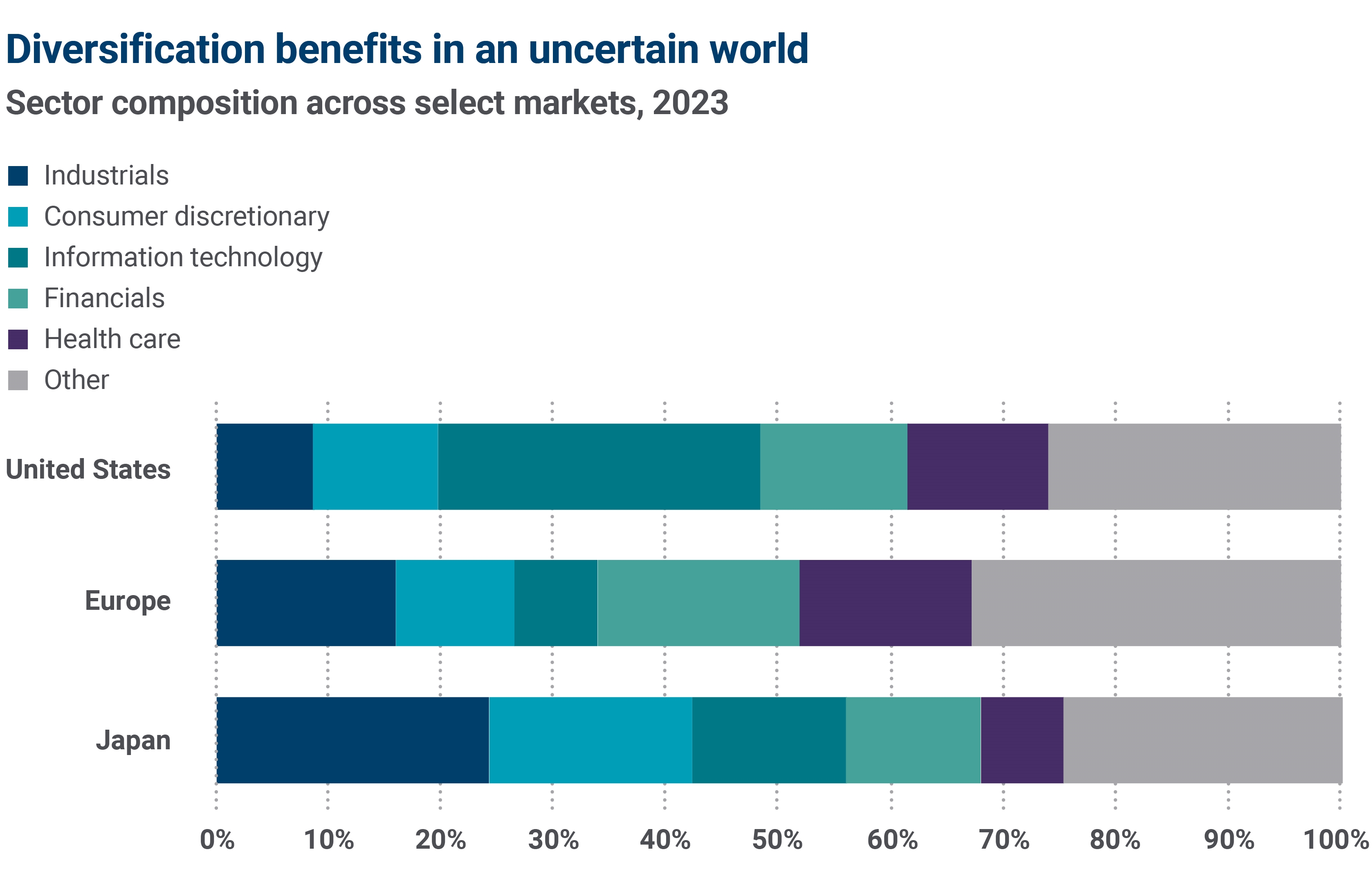

The U.S. stock market is very concentrated in a number of tech names. Even Asia ex-Japan, when you look at Korea or Taiwan, has a very big concentration in semiconductors. However, Japan’s market is much more diverse, as the chart below shows. As such, a global portfolio allocating to Japan may benefit from low correlation driven by macroeconomic policies, economic conditions and a stock market that are all inherently different from the rest of the world.

Source: BlackRock Fundamental Equities, Dec. 31, 2023. Chart shows GICS sector composition in the S&P 500 Index (U.S.), MSCI EU (Europe) and Topix (Japan) as of year-end 2023. Numbers may not add up to 100% due to rounding. Indexes are unmanaged. It is not possible to invest directly in an index.

3. Government support

The Japanese government has overhauled its tax-savings scheme for households to encourage reallocation from cash savings into securities. While this will take time to play out, the shift may be meaningful considering the decades-long preference for cash and the magnitude of flows (with cash piles estimated at trillions of yen) that could move to Japanese equities.

4. Corporate transformation

Unprofitable conglomerates are getting a shake-up. Japan used to have a significant number of conglomerates, or complex organizations with numerous listed subsidiaries. They were difficult to analyze, but many were also not profitable or had very low growth prospects.

Many of these companies are now restructuring, spinning off non-core business. The result has been improved multiples, higher profits and a positive reaction in equity prices. We believe this is just the start and that there may be a significant amount of embedded value that can be unlocked from corporate reforms going forward.

5. Stock exchange steps

The Tokyo Stock Exchange has made changes to compel companies to invest in their businesses, grow and thereby improve shareholder returns. Efforts initiated in 2023 were focused on companies with low book values, requiring them to take steps to increase their value within a prescribed timeframe or risk delisting. More recently, the exchange has called out companies that fail to report on their plans and progress.

Further, roughly half of the companies in Japan’s TOPIX index currently trade below book value (i.e., below the value of their assets). This means there is considerable upside in terms of corporate transformation.

A global force in mega forces

The opportunities in Japanese equities are broad and diverse. And in an ironic twist, many are driven by the headwinds that Japan has faced in recent decades. Among them:

- Aging demographics: An aging population has meant a declining workforce since the mid-1990s. As a result, Japan has focused on developing medical technologies and factory automation to address labor shortages. It is now home to companies that are leaders in these areas, providing services and factories not only domestically but around the world.

- Decarbonization: The transition to a low-carbon economy is front and center for Japan and had been even before it gained popularity globally. This is due to a long focus on the scarcity of natural resources as well as social values formed out of the demographic changes. It’s a country that has faced unbelievable earthquakes and tragic tsunamis, and there is a deeply felt duty to protect and preserve the environment in Japan. That, combined with the country's expertise in engineering and innovation, has resulted in the development of energy-efficient industries years before the rest of the world.

Bottom line

We expect broad interest in Japan to continue and investments to increase, though not all companies are ripe for the changing business environment and poised to benefit equally from the burgeoning transformations. Contact your Ameriprise financial advisor for personalized guidance on whether increased exposure to Japanese markets may benefit your investment portfolio over the long term.