“Will my savings last after I retire?”

It’s a common question. To answer it with more confidence, many investors turn to annuities to provide a reliable income stream in retirement. If you’re considering an annuity for retirement income, this annuities FAQ will answer some common questions and help prepare you for a conversation with us.

In this article

Not sure whether an annuity is right for your retirement goals? We can provide you with personalized advice based on your income needs, as well as solutions that may help protect you from uncertainty.

What is an annuity?

An annuity is a long-term insurance product that can provide guaranteed income.

Annuities are a common source of retirement income because they can provide a steady stream of payments at regular intervals and because their earnings grow tax-deferred1 until you withdraw funds. Most annuities also offer a death benefit that protects your original investment for your beneficiaries.

With people living longer and thus experiencing more market cycles throughout their lifetimes, annuities can help fill the gap between other sources of guaranteed and stable retirement income — such as pensions or Social Security — to help cover essential expenses if needed.

How do annuities work?

With an annuity, you pay the annuity company premiums for a period of time, and then the annuity company starts paying you.

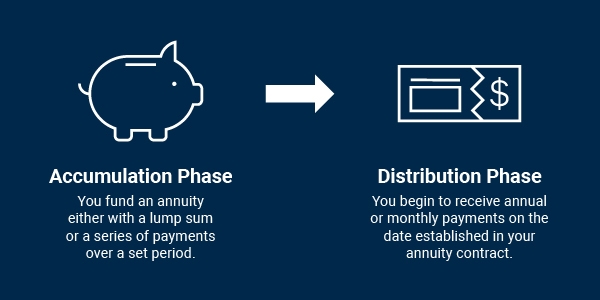

In general, annuities work through two different life stages:

- Accumulation phase: You pay premiums into the annuity. You can do this either with a lump sum or over a specific period of time, depending on the type of annuity.

- Distribution phase: You’ll receive monthly, quarterly or annual payments according to the terms of the annuity contract.

What are the different types of annuities?

There are two categories of annuities — deferred and immediate — and several types of annuities within each category. The most common deferred annuities are fixed annuities and variable annuities. Each offer a range of options to meet your needs. They also offer the option to annuitize – or convert – your account to a series of guaranteed income payments – for either a specific period of time or for as long as you live during retirement.

Deferred annuities

- Fixed annuities: Offer a fixed rate of return guaranteed to never fall below a minimum rate.

- Variable annuities: Offer growth potential from the underlying funds you choose. In addition, they provide a guaranteed death benefit for your beneficiaries.

- Structured annuities: Provide opportunities for growth and a level of protection that can help reduce some of the risk that comes with investing.

- Fixed index annuities: Credit interest based on the performance of indexes using a cap or spread.

Immediate annuities

- Immediate annuities guarantee an income stream in return for a lump-sum payment. Unlike a deferred annuity, there is no accumulation phase; the stream of payments begins shortly after the lump-sum payment. You can choose from a variety of income options, including some that provide income for your spouse or beneficiaries if you die prematurely.

All guarantees are based on the continued claims-paying ability of the issuing company and do not apply to the performance of the variable subaccounts, which will vary with market conditions.

Other annuity factors to consider

We can help you evaluate the different types of annuities and take your financial situation under consideration to determine which type of annuity is appropriate for you. We’ll ask questions about:

- Timing of your first payout

- Your risk tolerance

- Payout period

Timing of first payout: Immediate vs deferred annuities

When would you like the distribution phase to begin? Do you want payments to start immediately or be deferred to the future?

- Immediate: With an immediate annuity, you pay the principal (usually in a lump sum) and begin receiving payouts right away. This is a popular option for those about to retire.

- Deferred: With a deferred annuity, you make contributions ahead of time and receive the first payment on the date specified in your contract. Because your money has more time to accrue earnings tax-deferred,1 your payout amounts can potentially be higher than those of an immediate annuity.

Risk tolerance: Fixed vs. variable annuities

Different annuities carry different amounts of risk. Do you feel more comfortable with a fixed interest rate on your principal investment or are you willing to accept more risk for a variable — possibly higher or lower — rate of return?

- A fixed annuity offers a specified rate of return. You haven’t invested your principal in the markets, so your returns will not fluctuate with the markets.

- A variable annuity offers the potential for greater income than a fixed annuity because it’s invested in a markets-based product. However, with the potential for greater returns comes greater risk of potential loss of principal.

Annuity payout options

Do you want an annuity that guarantees payments for the rest of your life, one that pays out for a predetermined amount of time, such as 5 or 30 years, or some combination?

- With a life payout, you will continue to receive payments until you pass away. Payments will not continue for your beneficiary.

- With a period certain payout, you will receive payments for the period of time your contract specifies. If you pass away before the end of the period, your beneficiary will receive the payments until the end of the period.

- A joint-life payout provides a lifetime payout for the investor and one other person, typically a spouse. Because the annuity is likely to pay benefits for a longer period of time, the benefit amount will be lower than it would have been for a single-life payout.

- A life with period certain payout provides payments for the rest of your life, but if you pass away during a specified period, your beneficiary will receive payments for the rest of that period.

Are annuities taxable?

- Annuities are tax-deferred,1 which means you generally won’t have to pay income taxes as the money grows, but any untaxed amounts are taxable when withdrawn or received as part of annuity payments. Taxable amounts are subject to the ordinary tax rates.

- Annuities are intended for retirement investing, so withdrawals from a deferred annuity before age 59½ are subject to a 10% IRS tax penalty (in addition to the ordinary tax rates) on the taxable portion withdrawn unless an exception applies.

Learn more about annuities and taxes.

Are annuities only for retirees?

Annuities can be part of your financial picture in your working years as well as during retirement.

Because deferred annuities offer tax-deferral,1 you have more time to grow your money without paying income taxes on earnings. In that scenario, if you choose a variable annuity, you may have the option to invest in the stock market for growth and to protect your principal for beneficiaries.

Two additional reasons you might purchase an annuity before retirement:

- To roll over a workplace retirement account when you change jobs; and

- To continue saving after you reach 401(k) or IRA annual contribution limits

Is an annuity right for you?

Now that you understand the basics of annuities, consider asking the following: When is the right time to stop working and retire? Will your money last as long as you need it to? How can you protect your retirement income from losses?

These are key questions to discuss with us. We can provide you with personalized advice to help you achieve your financial goals.