Feel more confident about living the retirement you want, no matter what age or life stage you’re in.

Retirement planning isn't only for the retired. Rather, it’s a long game that requires consistent saving and intentional investing — at every life stage.

Wherever you are in your retirement journey, we are prepared to help you stay on track to reach your retirement goals and provide personalized retirement advice specific to your age and unique situation.

Here are seven essential retirement tips by age that can help you prepare right now.

In this article:

Under age 50

1. Envision your ideal retirement

It’s challenging to plan for retirement unless you know your ideal retirement lifestyle. So, think about how you want to enjoy your days. Maybe you want to continue working. Or do you want to travel, volunteer or become a professional grandparent? Perhaps you’ll build a cabin on a lake?

You can’t start thinking about your retirement too soon or obtain advice for retirement too early. Even if you think your goals might shift in the years ahead, thinking about them today gets the conversation started and helps you plan.

2. Identify your retirement numbers

Once you know what you want to be doing in your retirement years, you can figure out a rough estimation of how much you may need to save. To figure out your retirement numbers, use our retirement planner calculator to help identify specific savings targets.

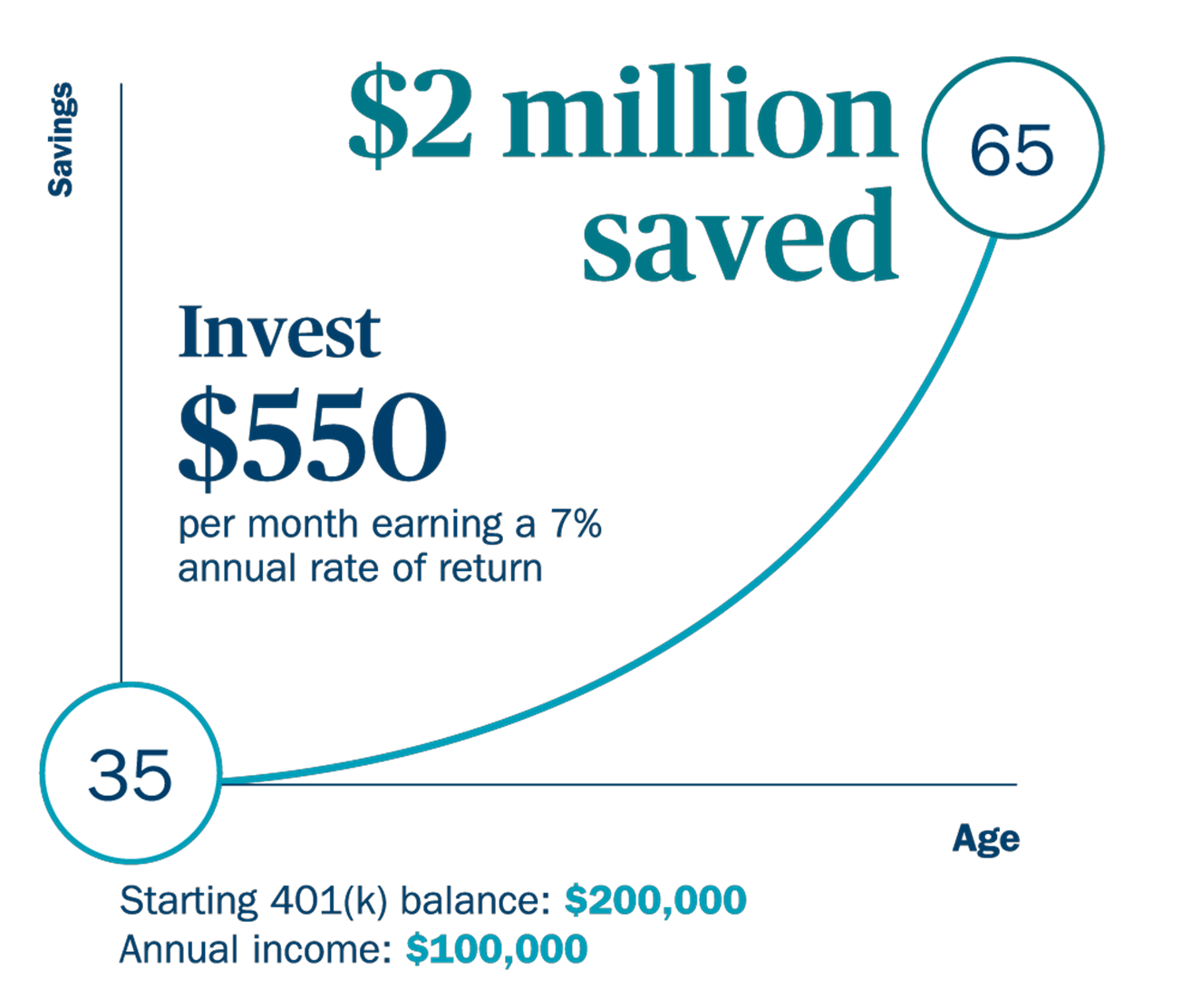

For example, let’s say you’re 35 years old, earn $100,000 a year and have $200,000 in your 401(k). You might determine you need $2 million saved by the time you’re 65. To get there, you may only need to invest $550 per month, assuming a 7% annual rate of return.

For illustrative purposes only. This example is not meant to represent any specific investment and does not consider fees or other expenses.

3. Save money at every opportunity

With rising retirement costs and longer life expectancies, you may need more money than you think. So, save as much as you can during your earning years. Workplace-sponsored 401(k) plans let employees invest a percentage of their income for retirement on an after and tax-deferred basis. Plus, your employer may match a percentage of your contribution. Aim to save at least 15% of your gross pay, if possible. If you’re not there yet, consider increasing your retirement savings contribution with every pay raise.

4. Go beyond the workplace with a Roth IRA

Beyond a 401(k), there are other tax-advantaged ways to save for retirement that aren’t tied to an employer. Consider opening a Roth IRA, which allows for after-tax savings and tax-free income in retirement, when certain conditions are met. This may help you hedge against the possibility of future tax increases.

However, Roth IRAs do have income limits and if you earn too much to contribute directly to one, there are alternate options. You could simply contribute to a traditional IRA, which does not have income limits, or consider a strategy such as a backdoor Roth IRA. Consult with your tax professional to determine if this strategy is appropriate for you.

5. Keep your asset allocation in check by regularly rebalancing

Asset allocation is the strategic apportioning of different assets types — including stocks, bonds, alternatives and cash — in your portfolio, based on your financial goals, risk tolerance and time horizon. The general goal is to help diversify your portfolio, keep you invested and soften the effects of big market fluctuations.

However, over time, market swings can throw your portfolio’s asset allocation out of balance. That’s why it’s important to regularly rebalance your portfolio. Rebalancing brings your investments back into alignment with your risk tolerance and long-term strategy, helping you stay on track toward your goals.

6. Steer clear of emotional investing

As investors, our emotions tend to follow market cycles. When markets rise, our outlook improves, and we are inclined to invest more. When markets turn down, our outlook becomes more pessimistic, and we are inclined to invest less. Some investors may even pull out of the stock market just as it reaches its low, missing out on potential gains as it rises again.

Bottom line: Emotions can cause us to do the opposite of what we should do. That’s why regularly investing, and staying invested, over the long-term is a smart approach for most investors.

7. Consider insurance to help reduce your worries

Even with a smart saving and investing strategy, unexpected events can occur. You could experience an illness that prevents you from working and earning an income. Or your home could be damaged in a storm. To protect yourself against these risks, consider how insurance — whether it's life insurance, disability income insurance, long-term care coverage or auto, home and umbrella life policies — can help. With sufficient protection, you can focus on planning for the future, without worrying too much about life’s uncertainties.

Age 50 - 62

1. Add details to your goals

Start planning for the retirement lifestyle you've long strived for. You may have decided to spend your retirement years traveling, volunteering or becoming a professional grandparent. Now that you're a little bit closer to retirement, get more specific and start to refine your retirement vision.

2. Catch up if you need to

Prioritize saving as you near retirement. Max out contributions to your retirement accounts as much as you can. If you’re between 50 and 64 years old, you’re eligible to make extra “catch-up” contributions to your 401(k) and IRA to help you meet your retirement goals.

3. Consider consolidating retirement accounts

By this point, you may be juggling multiple retirement accounts, making it difficult for you to manage your money and have a full financial picture. Consider the pros and cons of consolidating these accounts before retirement so you can easily and effectively tap into your money when you need it.

4. Plan for health care expenses

Health care expenses are an often-overlooked expenditure in retirement planning, but these costs can be significant. Medicare wasn’t designed to cover health care expenses in full and retirees are responsible for paying for deductibles and copayments, as well as dental and vision care.

As such, start thinking about how you'll cover health costs in retirement, and consider funding a health savings account (HSA), if you’re enrolled in a high-deductible health plan. An HSA is a tax-advantaged account that enables you to use pre-tax money to cover eligible, out-of-pocket medical expenses. However, any distributions taken prior to age 65 that are not used for eligible medical expenses are subject to income tax and a penalty.

5. Start planning for retirement income

Your retirement can last for decades, and you’ll want to have multiple income streams to help ensure your retirement savings endures. At this point in your journey, you may want to consider strategies like tax diversification or purchasing an annuity, which can provide a steady income stream throughout your lifetime, or adding dividend-paying stocks to your portfolio.

6. Investigate long-term care

Medicare does not cover extended stays in nursing homes and other long-term care facilities. However, about 70% of Americans who reach age 65 will need long-term care at some point, according to the Department of Health and Human Services.1 In your 50s and early 60s, consider purchasing coverage that could help pay for the cost of a long stay in a facility or in-home care. It's typically more cost-effective to lock in premiums while you're younger.

7. Reevaluate how you invest

How you invested when you were 40 is not necessarily how you should invest at 50 or 60. Your risk tolerance changes over time, and as you get closer to your retirement, it’s smart to focus on preserving your wealth, as much as growing it. At this point, you may want to revisit your portfolio’s asset allocation and consider how your shorter time horizon may affect your risk tolerance and investment mix. For example, as retirement draws closer, it’s not uncommon for retirees to shift from a more aggressive allocation to a more conservative one.

Age 62+

1. Be strategic with your Medicare and Social Security benefits

As you enter your retirement years, continue to review your progress and assess your position. You will not only want to consider strategic adjustments to your portfolio, but also think about the big upcoming retirement milestones, such as enrolling in Medicare and deciding when to file for Social Security.

2. Establish a spending plan

In the year leading up to retirement, consider tracking your expenses so you can better understand how much income you’ll need to withdraw in retirement. For many retirees, the transition from earning income to withdrawing income can be an adjustment, so creating a spending plan can be helpful for managing expenses.

3. Create a sustainable withdrawal strategy

Once you know the amount of income you’ll need, create a withdrawal strategy that accounts for your different income sources, your required minimum distributions (RMDs) at the appropriate age and your financial goals. While a general rule for withdrawing money from retirement savings is to take out up to 4% each year, everyone’s situation is unique. After years of accumulating assets in your retirement accounts, it may feel strange to switch to this phase, but it’s important to remember that you’ve worked hard to get to this point.

4. Take advantage of tax diversification

How you withdraw from your various taxable and tax-deferred accounts in retirement — and which you tap first, second and so on — determines the taxes you owe and may help your assets last longer. It's generally wise to tap taxable savings before tax-advantaged retirement accounts, but every person’s situation is unique. For example, there may be tax benefits to withdrawing from several different types of retirement savings accounts at the same time. Consult with your tax professional to determine the strategy that is appropriate for you.

5. Make your retirement savings last

A common mistake retirees make is shifting a big portion of their retirement assets to cash and fixed-income investments. Since you have less time to recover from market downturns, investing more conservatively in retirement can be wise. However, you don’t want the purchasing power of your investment portfolio to be eroded by inflation. Retirement can last more than 30 years, so it's important to take steps to help your retirement savings last longer.

6. Prepare for the long run

Planning for your later years is crucial. People often only plan for their early retirement years when they can travel the world or enjoy their favorite activities. But those activities may not be as realistic as you age. Think through how you hope to spend your later retirement years and work through some unexpected scenarios. Then you can take steps to prepare, such as securing long-term care coverage to help pay for any services you may need or making modifications to your home to make it more accessible as you age.

7. Keep checking in with your goals and finances

Don't leave your retirement on autopilot. Priorities often change over the course of retirement for many reasons. Reviewing your goals periodically can help you feel more confident that you can continue to live the retirement you want.

Prepare for retirement — at every life stage

We are prepared to provide you with retirement advice by age and recommend strategies to help you stay on track — so you can enjoy the retirement you’ve always envisioned.