When it comes to Social Security, there is a lot to consider. Social Security is often associated with a retirement program, but you may enroll if you become disabled or lose a family member. Take a look at the diagrams below for information on how to make the right choices for you and your family.

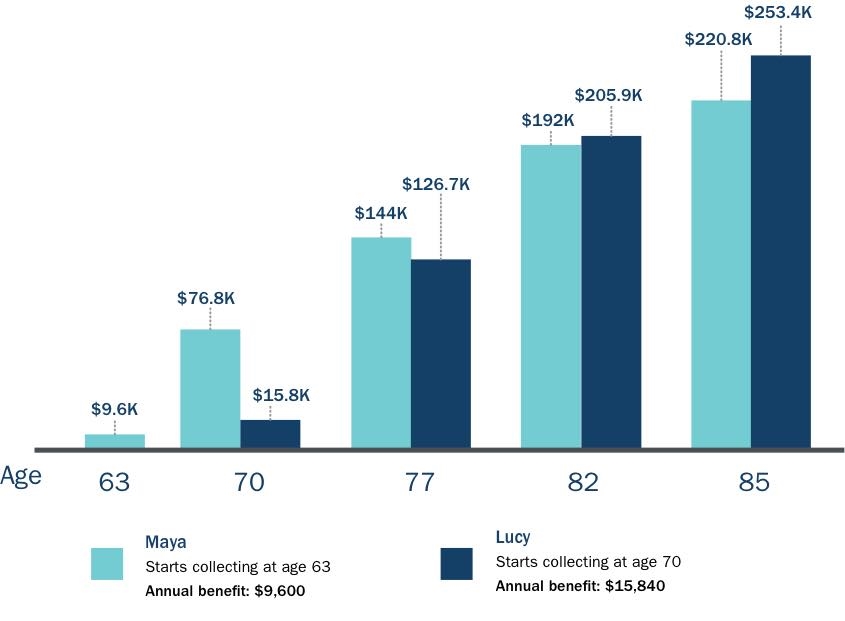

When should I start collecting Social Security benefits?

The answer is different for every person and depends on many individual factors like your date of birth, marital status and financial position.

The longer you wait to start collecting Social Security, the higher your monthly benefit will be. We can help you determine an appropriate time for you based on your financial situation and goals.

What is my full retirement age?

Your full Social Security retirement age depends on the year you were born. If you were born on January 1 of any year, refer to the previous year to determine your full retirement age.1

|

Year of birth

|

Retirement Age

|

| 1943-1954 |

66 years old |

| 1955 |

66 +2 months years old |

| 1956 |

66 +4 months years old |

| 1957 |

66 +6 months years old |

| 1958 |

66 +8 months years old |

| 1959 |

66 +10 months years old |

| 1960 |

67 years old |

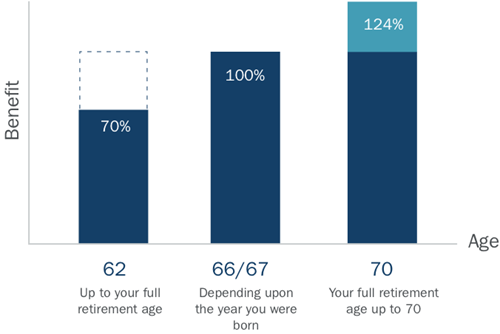

How do my Social Security benefits change if I retire early or late?

As life changes and priorities shift, you may wish to retire before or after your full retirement age. Your Ameriprise financial advisor can help you determine an appropriate choice for you. Retiring early locks you into lower monthly payments and will decrease your lifetime benefit amount. Retiring later increases your monthly payment and the amount you will receive over your lifetime.

Can I receive the Social Security benefits of my spouse?

As the spouse of someone receiving benefits, you may be able to claim benefits based on their income, even if you have never worked under Social Security. You may be eligible for benefits if you are:

Can I collect benefits on behalf of my child?

You may be able to claim benefits if the child you are caring for fits the following criteria:

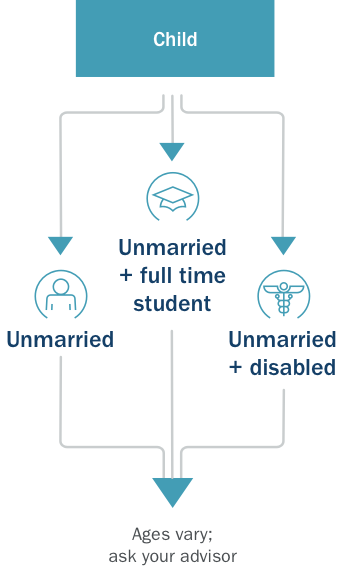

Can my children receive Social Security benefits?

A child who has a parent who is disabled or retired and entitled to Social Security benefits may also be eligible for benefits if they are:

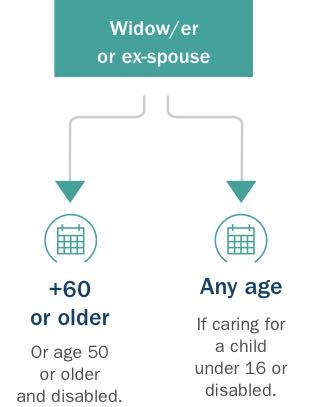

Am I eligible for survivor’s benefits?

You may be eligible for survivor's benefits if you are:

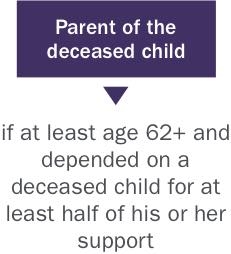

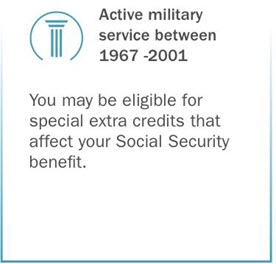

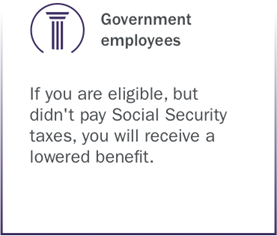

How does my military service or government employment affect my Social Security?

As a veteran or government employee, your Social Security benefits may differ from others:

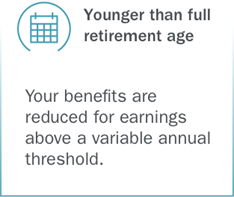

Can I still work and collect Social Security benefits?

You can collect Social Security benefits while working, starting at age 62. However, your age and earnings may impact the amount of benefits you receive during that time. Working won't permanently reduce the Social Security benefits you receive, nor will your withheld benefits disappear.

Once you reach full retirement age:

- Your monthly benefit will increase, taking into account prior benefits detained due to earnings.

- Extra income no longer decreases your benefits.

If you work and collect Social Security when you are:

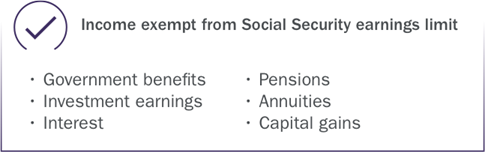

These types of income are exempt from the Social Security earning limit:

*If you work for someone else, only your wage amount applies to earnings limits. If you're self-employed, only your net earnings count.

Does Social Security allow for inflation or cost of living increases?

The Social Security Administration can enact yearly benefit increases called cost-of-living adjustments (COLA) based on inflation. Since 1975, COLAs have ranged from 14.3% (1980) to 0.0% (2009, 2010, 2015). Your financial advisor can help you identify other sources of income when Social security inflation adjustments are low.

|

Year

|

Cost of Living Adjustment

|

|

2022

|

8.7%

|

|

2021

|

5.9%

|

|

2020

|

1.3%

|

|

2019

|

1.6%

|

|

2018

|

2.8%

|

|

2017

|

2.0%

|

When and how do I apply for Social Security?

We can help you navigate the process of applying for Social Security.

You can currently apply for Social Security in the following ways:

We can help

If you have any questions about Social Security, we can help you understand all aspects of your benefits and help you live more confidently so if your life changes, your plan can too.