A new class of drugs — known as GLP-1 agonists — has proved effective at helping individuals to manage their weight. As a result, consumer demand for medications like Ozempic has soared as pharmaceutical companies address a long-held health struggle for many Americans: weight loss.

Here’s what investors should consider:

Addressing a gap in the market

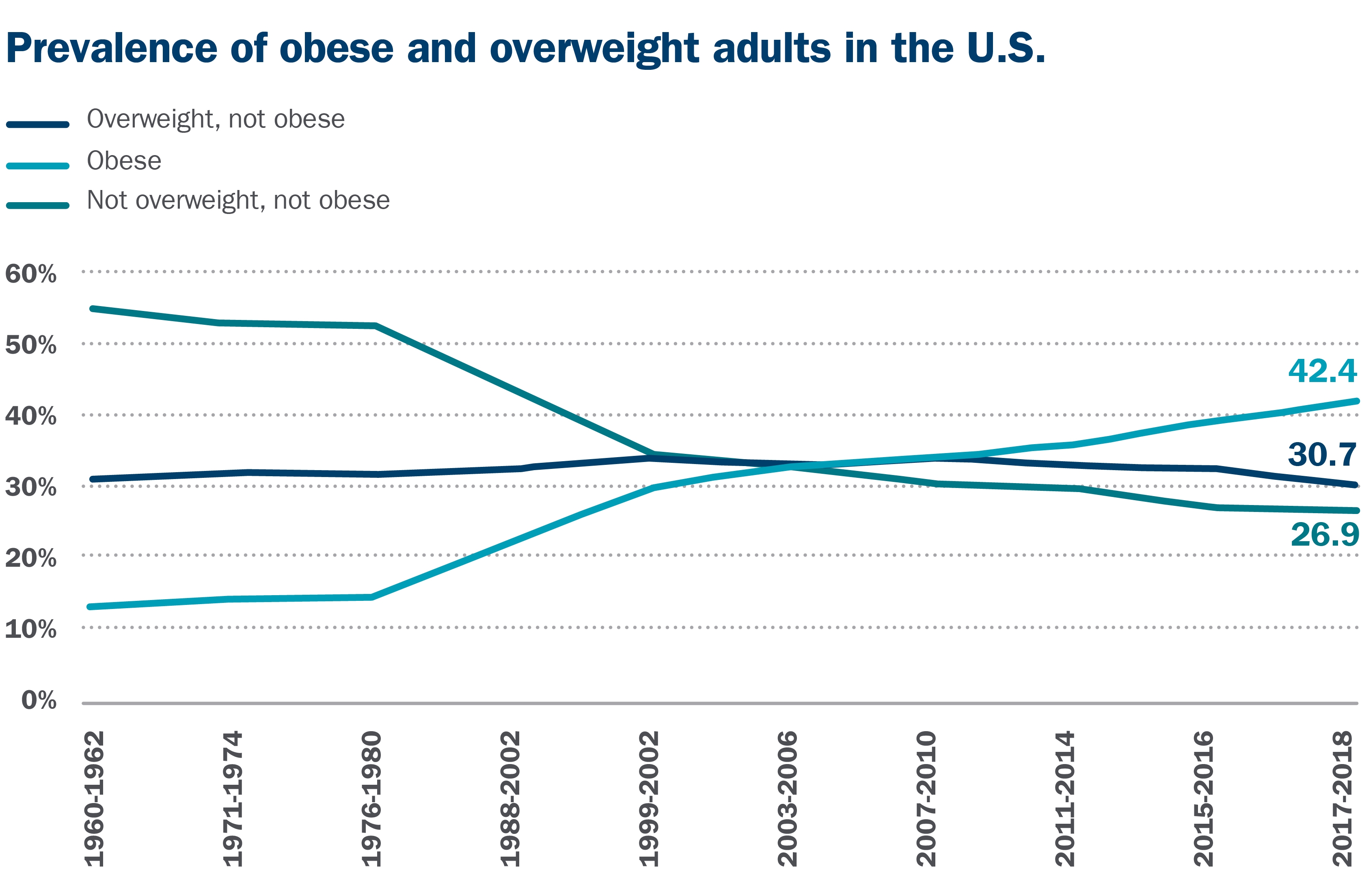

As of 2018, more than 100 million American adults (42% of the population) were obese and 80 million (31% of the population) were overweight, according to the Centers for Disease Control and Prevention (CDC).

Source: Centers for Disease Control and Prevention, data as of 2018.

While the health consequences of obesity — including increased risk for cardiovascular disease, type 2 diabetes and respiratory issues — are well-known, the economic impact is often underappreciated.

According to the Milken Institute, direct health care costs attributable to high weight approximate to $500 billion per year — paling in comparison to the $1.2 trillion in indirect costs related to work absences, lost wages and reduced productivity.1 Together, the costs borne by governments, employers, insurers and individuals equal 9% of U.S. gross domestic product (GDP).1

Turning the tide

Addressing this health issue could have positive impacts on the health of individuals, as well as corporations and the overall economy. The class of drugs dubbed GLP-1 agonists, originally developed to treat type 2 diabetes, has proved effective at treating obesity.

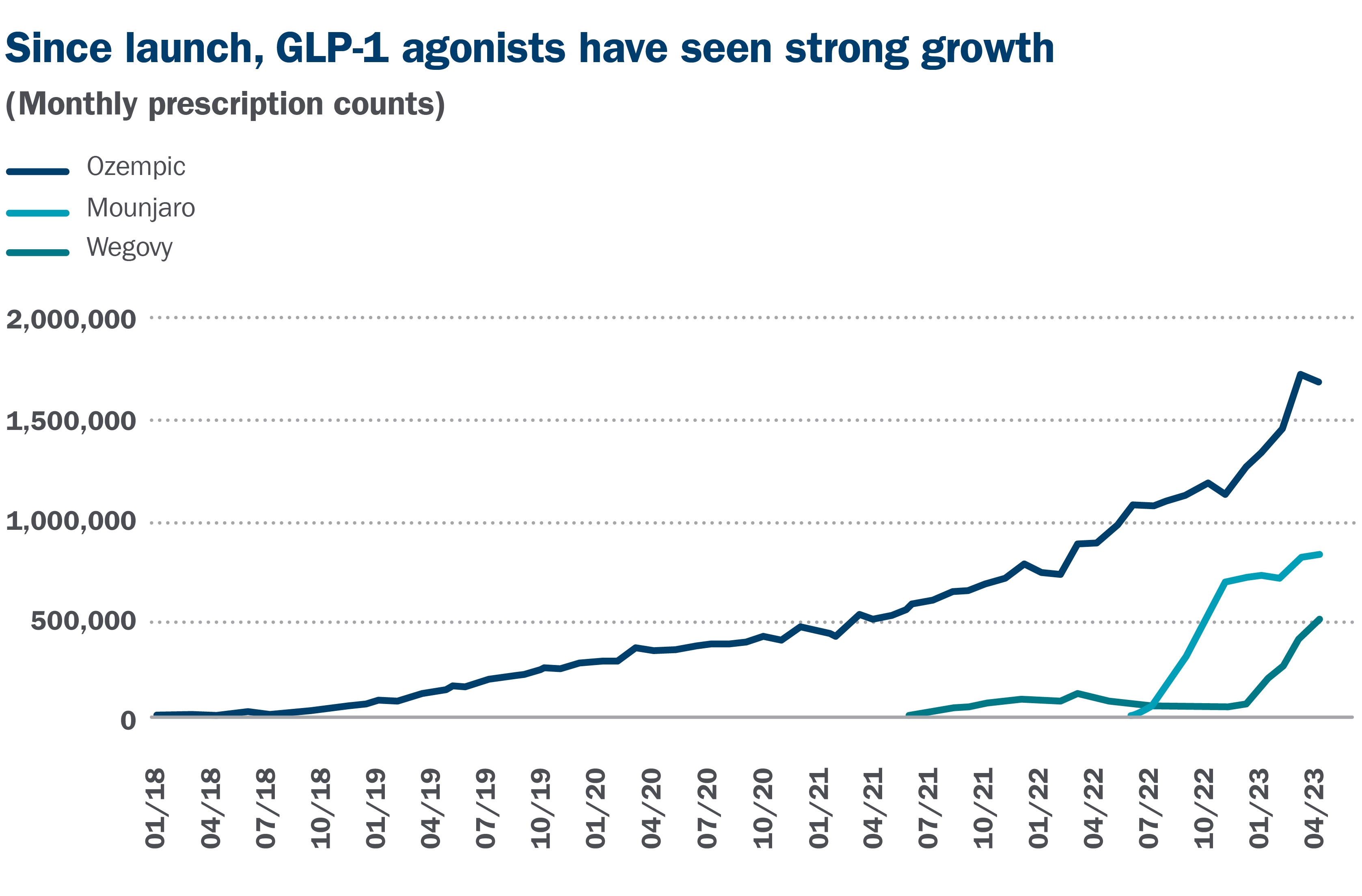

Demand has soared. Prescriptions have increased eightfold in three years, and approximately 4 million Americans currently take the latest generation of GLP-1s.2

Source: Columbia Threadneedle Investments as of April 2023. Data for Ozempic reflects prescriptions for diabetes; data for Mounjaro reflects diabetes and off-label weight-loss prescriptions; data for Wegovy reflects weight-loss prescriptions.

Runway for growth

The growth of GLP-1s has occurred despite supply constraints and high prices (prescriptions can cost up to $1,400 per month). As with most drugs, we expect prices will fall as competition and supply increase. When prices do decrease, demand will likely increase accordingly. Experts forecast the size of the GLP-1 market will double to $71 billion by 2027.3

In addition to treating obesity, GLP-1s have demonstrated promising results in preventing other ailments, including strokes and heart failure. Trials are underway to gauge their effectiveness in treating Alzheimer’s, sleep apnea and kidney disease. If GLP-1s are approved in even one of these areas, the market for these drugs will expand — as could potential investor opportunity.

A choice for providers

As more people want access to these drugs, health plan providers must decide whether to cover the cost for plan participants. Most insurers are not covering weight-loss drugs unless required to by state law, so there are limited cost risks for commercial insurance.

Currently, Medicare doesn’t cover GLP-1s for weight loss, and for those with access to Medicaid, 10 states require coverage of GLP-1s for weight loss. In a recent survey, 25% of employers said they cover GLP-1s and 40% said they plan to offer coverage in 2024.4 At up to $1,400 a month per patient, GLP-1s represent a major cost for plans that cover them, but again, that cost could decrease over time.

One reason some companies are willing to cover the drugs despite the cost? GLP-1s can bring meaningful benefits: healthier workers, lower absenteeism and reduced spending on other drugs and procedures related to obesity, from diabetes to heart attacks.

Bottom line: Demand for GLP-1s is growing. And they will have an impact on health care providers, individuals, companies and the overall economy in the years to come.

Make sense of the market impact

Your Ameriprise financial advisor is well-positioned to help you take advantage of these and other new investment opportunities, aligned with your risk tolerance, time horizon and financial goals.