Diversify the tax treatment of your investments to help reduce the taxes you pay now and in retirement.

Your retirement could last several decades, so it’s important to not let taxes eat away at your savings more than necessary. One way to safeguard against this is through tax diversification, a strategy that uses a variety of investment vehicles with different tax treatments to help you keep more of your money — now and in the future.

We can work with you to incorporate the principles of tax diversification into your overall financial strategy.

Here’s how this strategy can potentially help you keep more of your hard-earned savings:

In this article:

What is tax diversification?

Similar to how you diversify the type of assets in your portfolio to hedge against risk, it’s also smart to diversify the taxability of your investments to hedge against future taxes.

This is a strategy known as tax diversification and it accounts for the various tax treatments of the different accounts you will eventually withdraw from, as well as their required minimum distribution (RMD) rules. When coupled with a tax-efficient withdrawal strategy, tax diversification can offer you flexibility, increased control and longevity with your retirement income.

How tax diversification works

The IRS taxes your investments differently based on the type of account it’s housed in. Tax diversification is a strategy that spreads your funds among accounts with three different tax treatments during your working years as you save for your retirement and other financial goals:

- Tax-deferred accounts are typically funded with pretax contributions. Pretax contributions allow you to lower your current taxable income, while earnings grow tax-free. Withdrawals are generally taxed as ordinary income, though any distributions prior to age 59½ may also be subject to a 10% early withdrawal penalty. Generally, distributions are required to begin at age 73.1

- Pretax examples include: Traditional IRAs2, 3, SIMPLE/SEP IRAs2, pension plans2 and 401(k) 2 and 403(b)2 plans.

- After-tax examples include: Traditional IRAs funded with after-tax contributions, nonqualified annuities2, series EE bonds5 and 401(k) plans that allow for after-tax contributions.

- Tax-free accounts are funded with after-tax money. Earnings and withdrawals can be tax-free, provided certain conditions are met.

- Examples include: Roth 401(k) plans2,6, Roth IRAs2,6, cash value life insurance6,7, municipal bonds8, tax-exempt mutual funds8, 529 plans9 and health savings accounts (HSAs).

- Taxable accounts10 are funded with after-tax money and earnings create taxable income, such as interest when earned, dividends when paid or capital gains or losses when realized.

- Examples include: Nonqualified brokerage accounts containing mutual funds, stocks and bonds, and checking or savings accounts.11

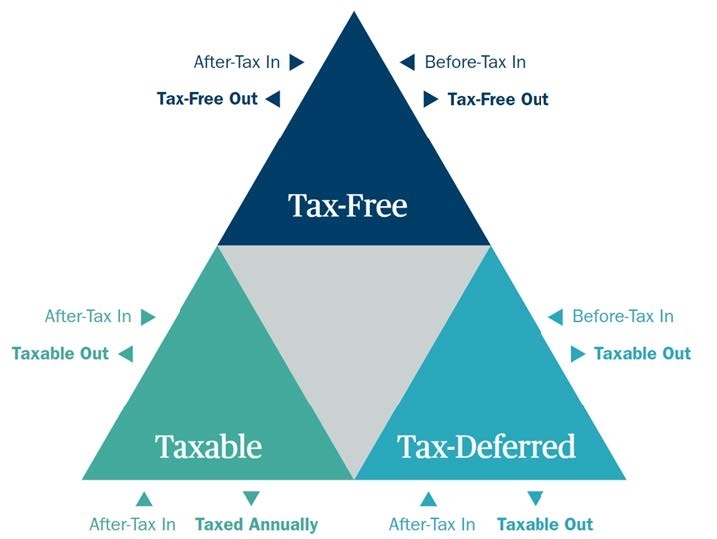

What is the tax diversification triangle?

The tax diversification triangle, also known as the tax control triangle, can help you visualize the tax treatments of your investments across your portfolio.

What are key benefits of tax diversification?

It’s common for investors to gravitate toward tax-deferred accounts, such as a 401(k), pension or traditional IRA, during their working years. But while these investments can lower taxes today, solely funding these types of accounts can cause you to be over-concentrated in assets that are taxed in retirement and subject to RMD rules.

By employing a tax diversification strategy, you potentially can:

- Take more control of your finances, now and later. Taxable and tax-free accounts do not have distribution requirements during your life, allowing you to control when and how much you withdraw. And though qualified tax-deferred accounts generally require distributions at age 73, you can still control distributions from those accounts before that age and any amount you take over the RMD after you turn 73.1

- Potentially fuel savings over time and help your assets last longer. Having the ability to choose which assets are used for income can allow you to spread your taxable distributions over more years to manage tax brackets, so you pay less in taxes and keep more of your savings.

- Gain flexibility in how you access retirement income. Life events are likely to change your savings and income needs in the future. Diversifying your savings among different tax treatments will give you greater flexibility when the unexpected happens.

- Pass on more to your loved ones. In addition to giving you greater control over your retirement income, tax diversification can give you more flexibility when managing the transfer of your assets to beneficiaries and loved ones.

Tax diversification strategies by life stage

There isn’t a one-size-fits-all approach to tax diversification, since your income, time horizon and account mix will all affect what may work best for you. Still, there are some common steps you can take to help diversify the taxability of your investments.

During your working years

In general, the priority during your working years is to reduce your taxable income, especially during your peak earning years, while strategically saving money across taxable, tax-free and tax-deferred accounts:

- Make tax-deferred contributions to a qualified retirement plan. Saving money in a tax-deferred qualified retirement plan such as a 401(k) is a fundamental part of long-term financial planning. If your employer offers a match, your priority should be to contribute enough to get the full amount. If you don’t, you’re essentially leaving money on the table.

- Utilize an HSA, if you qualify. Because you own your HSA and the unused account balance rolls over each year, it can potentially provide a source of retirement savings that you can often invest, which can help pay for health care expenses now or in the future.

- Leverage Roth accounts to benefit from tax-free withdrawals. Your contributions won’t reduce your current taxable income, but your money will have a long time to grow, and you won't have to pay taxes on earnings or withdrawals in retirement. Also, unlike qualified retirement accounts, you will not be required to take RMDs during your lifetime.

- Take advantage of employer stock. If it’s an option offered by your employer, consider enrolling in a nonqualified deferred compensation (NQDC) plan. It will allow you to defer a much larger portion of your compensation than a qualified retirement plan and potentially provide favorable tax options.

- Explore nonqualified savings options. If you’ve maxed out your contributions to tax-advantaged accounts, consider investing in stocks, bonds and mutual funds in a brokerage account. Income generated in these accounts is typically taxable (in some cases at a lower rate), but there is generally more flexibility with withdrawals.

Learn more: Roth IRA strategies for high-income earners

Before retirement

Thoughtful planning in the years leading up to retirement can help extend your income further.

- Consider Roth conversions. Consider taking advantage of Roth conversions when markets are down and your income is lower. By doing this, you can likely reduce the amount of taxable income in retirement and potentially forgo RMD obligations. You will generate taxable income on the conversion of pretax contributions and earnings, but once the money is in the Roth, growth and withdrawals are tax-free.

- Take advantage of net unrealized appreciation (NUA) rules. If you have highly appreciated employer securities in your 401(k) or other qualified retirement plan, you may be able to convert some plan assets from being taxed as ordinary income to being taxed at long-term capital gain rates. Given the complexity of NUA rules, talk to your plan administrator and your tax advisor before making decisions.

During retirement

To benefit from tax diversification, it’s important to have a tax-diversified portfolio and a tax-efficient withdrawal strategy that accounts for the impact of required minimum distributions:

- Think strategically about distributions. Strategically managing distributions from tax-deferred, tax-free and nonqualified accounts in retirement can potentially help you pay less in taxes throughout your overall retirement. For example, it may be advantageous to take distributions from tax-deferred retirement accounts such as a traditional 401(k) or IRA before you are required to if you’re in a lower tax bracket. In other circumstances, you may realize long-term capital gains to take advantage of lower tax rates available below certain income levels.

- Utilize qualified charitable distributions (QCDs). If you’re 70½ or older, you can transfer up to $108,000 in 2025 from a traditional IRA, tax-free, to a qualified charity each year. This distribution can count as your RMD without being added to your adjusted gross income, and you won’t have to itemize deductions to take advantage. Using this technique to keep your RMD out of your adjusted gross income can also help you avoid Medicare surcharges and reduce the proportion of Social Security benefits subject to taxes.

Make your money last longer

We can review your investment accounts through the lens of the three different tax treatments — taxable, tax-free and tax-deferred — and help you decide how to strategically allocate your assets among them.