Stephen Dover, CFA, Chief Investment Strategist – Franklin Templeton

This article is intended to provide perspective on how potential election outcomes may impact financial markets and investments. These insights are not political statements from Ameriprise Financial, nor an endorsement of a particular candidate or political party.

The field is set for the U.S. 2024 presidential elections. President Joe Biden will stand for re-election, while former President Donald Trump will challenge him. Several notable third-party (or “no-label”) candidates will also be on many state ballots and, as the history of U.S. elections shows, they could prove difference-makers in November.

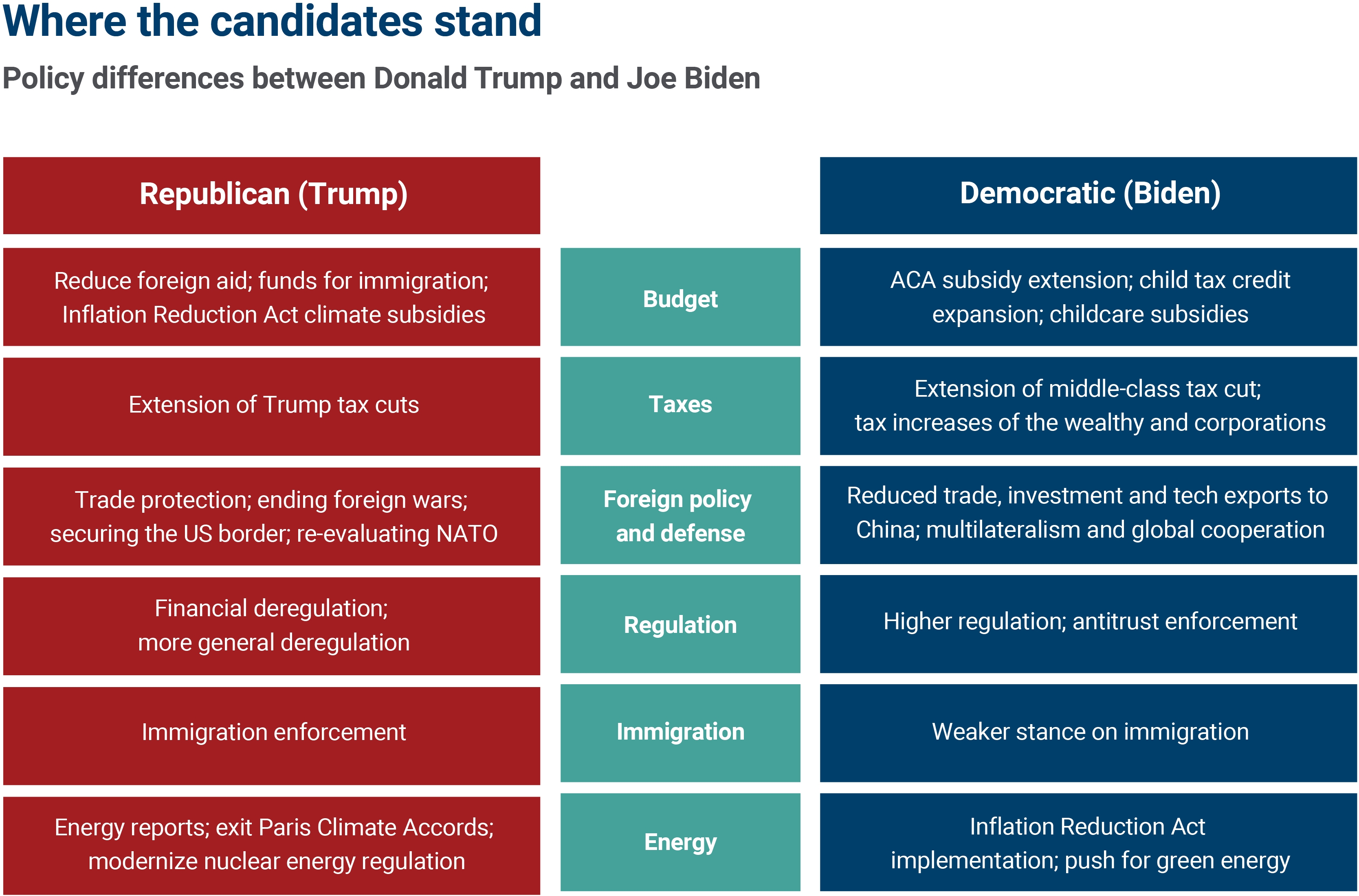

Here’s a summary of key policy differences the major parties offer and the potential implications of competing policy outcomes for capital markets this year and next.

Setting the stage

While both major parties offer seemingly clear policy differences, neither of the presidential candidates has yet to lay out a fully formed party platform. (That process typically culminates around the respective party conventions later this summer.) Nevertheless, here are the likely differences:

Source: Analysis by Franklin Templeton Institute.

What about divided government?

Presidential power is relatively limited in legislative matters unless majorities in both houses of Congress (i.e., the U.S. Senate and the U.S. House of Representatives) are the same party as the president. And, as U.S. politics has become more partisan in recent years, legislation on various issues — including defense spending, appropriations, taxation and immigration — has been stymied by divided government. Accordingly, in many cases, platforms may be watered down partly or entirely if the president’s party does not also enjoy majorities in the Senate and House.

However, legislation around federal taxation is likely to emerge in 2025 even if divided government in Washington, DC, is the outcome of the 2024 elections.

Large parts of President Trump’s signature 2017 Tax Cuts and Jobs Act (TCJA) are set to expire at the end of 2025. Unless legislation addresses this, taxes will rise for many Americans — an outcome both parties are keen to avoid.

Specifically, most U.S. households will pay higher marginal rates of taxation and enjoy a smaller standard deduction if the TCJA expires unaddressed at the end of 2025. Moreover, the level at which estates will be liable for federal inheritance taxation will halve unless new legislation is passed next year. In contrast, most of the changes to corporate taxation, apart from “bonus depreciation,” will not automatically “sunset” in 2025.

As noted, incumbents in both parties will want to avoid hitting many Americans with higher taxes in 2025. Hence, irrespective of how the U.S. elections turn out, we expect Congress and whoever is president will find a way to extend many, if not all, of the provisions of the 2017 act to at least the majority of taxpayers. Both parties seem to agree that taxpayers with annual incomes under about $400,000 would not have their taxes increased.

Budget deficits and interest rates

Unless other taxes are raised, that would mean that the onus of deficit reduction will fall on spending restraint. Without mechanisms to reform the major mandatory programs of Social Security and Medicare, which are among the most popular government programs in both parties, deficit reduction will be difficult to achieve, in our view. That is because mandatory spending, plus interest on the national debt, accounts for over 70% of total federal government spending.1 With the defense budget making up half of the remaining discretionary spending, Congress and the president will be hard-pressed to find the cuts needed to reduce the deficit.

That does not mean, however, that budget deficits must grow as a percentage of gross domestic product (GDP). They have been falling for the past two years and, barring an economic downturn, the federal deficit is expected to stabilize or even modestly fall further relative to GDP.

For that reason, as well as the potential likelihood that falling inflation should enable the Federal Reserve to cut interest rates this year and next, government bond yields are likely to fall irrespective of who is elected president and which party controls Congress.

Implications for capital markets

From a macroeconomic, fiscal or monetary policy perspective, it is difficult for us to conclude that the choice of U.S. president or the change in majority control in Congress (if any) will have a material impact on variables such as growth, aggregate profits or interest rates — key factors that drive overall capital market returns.

That is not to say, however, that risk premiums will remain low. A contested election, would presumably have significant short- and possibly longer-term implications on how domestic and international investors assess U.S. country risk. Should a divided government in 2025 lead to the recurring threat of government shutdowns and a potential default, that would also have adverse impacts on risk assessment.

To the extent that the elections impact investment decisions, it is more likely to be in sector and industry outcomes. A “clean sweep” by Trump and the Republicans, for example, may likely benefit many of today’s more heavily regulated sectors, such as finance, health care and carbon energy (oil, coal and gas). Alternatively, beneficiaries of a “clean sweep” by Biden and the Democrats could include alternative energy and infrastructure sectors.

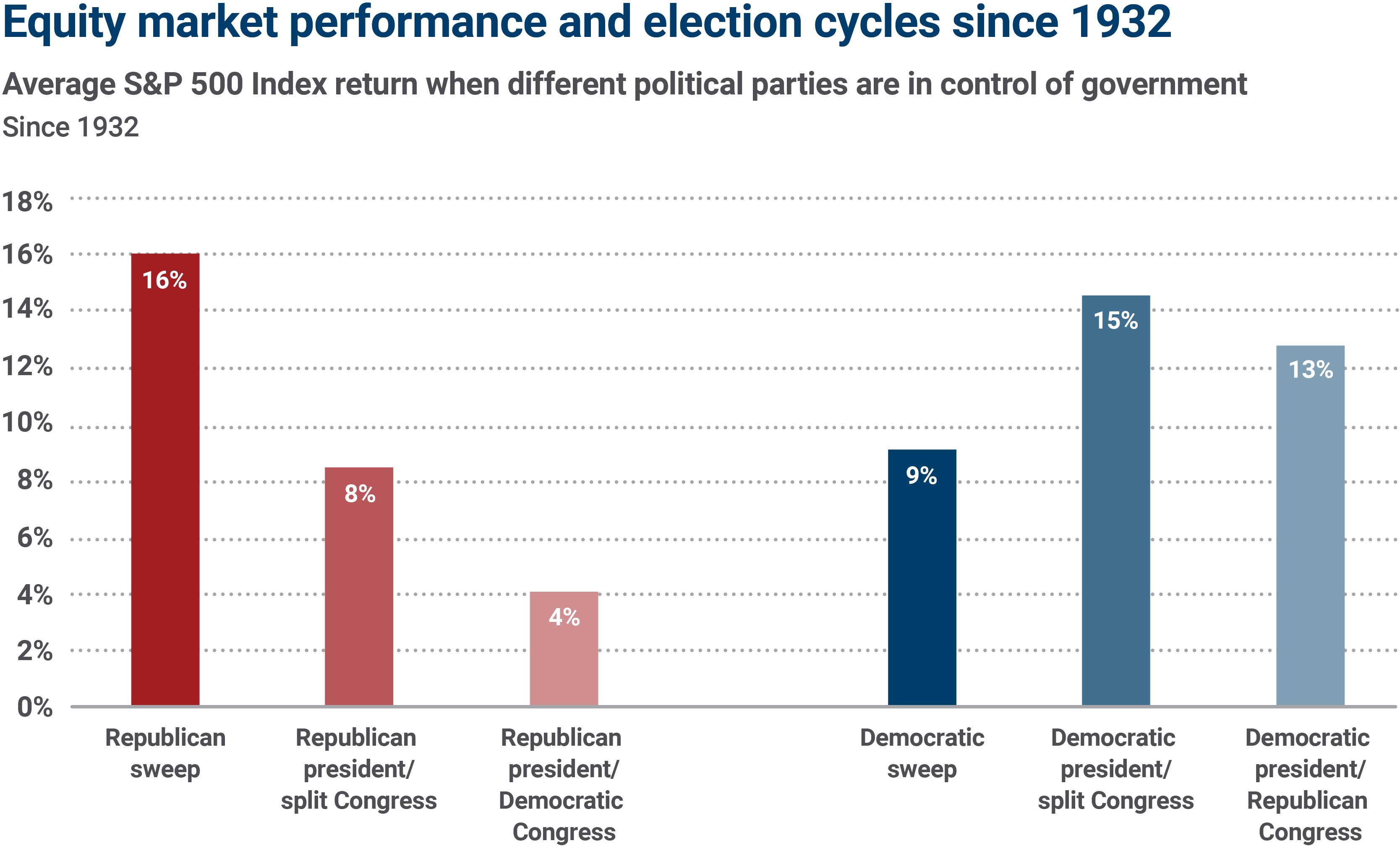

We are not persuaded that performance under past partisan outcomes in Washington (see the chart below) will be useful guides for investors today. Both parties have changed significantly from what they were over the past decades.

Sources: Bloomberg, S&P Dow Jones Indices. Note: The period references of the governments were taken from History, Art & Archives of the United States. Data until February 2024. Indexes are unmanaged and one cannot directly invest in them. They do not include fees, expenses or sales charges. Past performance is not an indicator or a guarantee of future results.

The current high equity-market valuations (above long-term norms) and earnings (higher than long-term averages) suggest that overall equity market returns are likely to be lower over the next five to 10 years than they have been over the first quarter century of this millennium. The party or parties in power could make matters worse or perhaps better, of course, but the prospects for sustained strong equity gains may not be favorable no matter who wins.

In our examination of the three years before the Trump presidency, the first three years of President Trump’s term, and the first three years of President Biden’s term, a few key conclusions emerge about the present environment:

- Starting valuations for the equity and credit markets are higher.

- Interest rates are at a much higher starting point.

- Earnings expectations are higher, while GDP expectations are lower.

- Consumer confidence is lower.

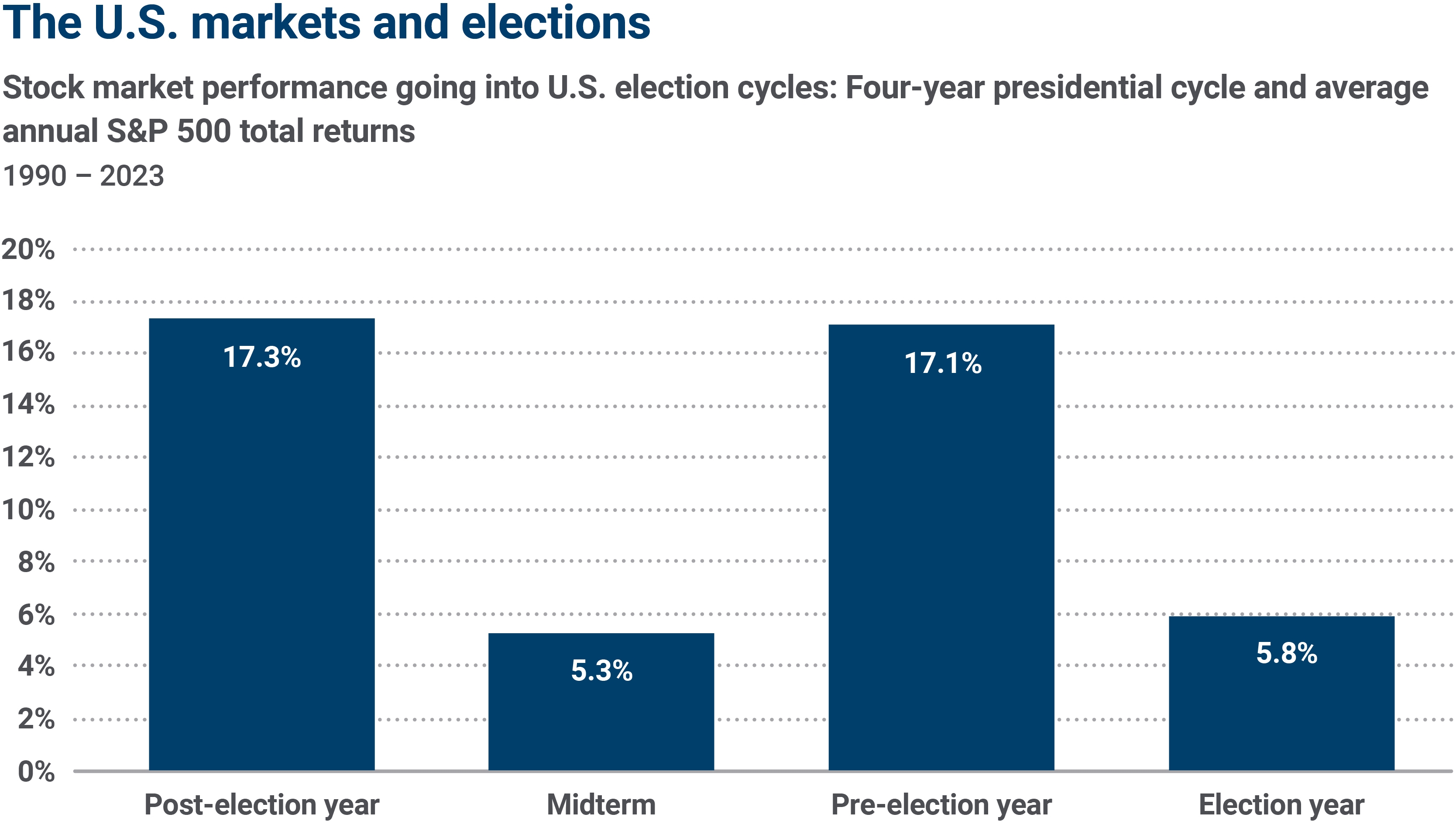

What does this say about the prospects for markets in the runup to the November elections? If history is an indicator, equity returns during election years have been subdued, as the chart below shows. That strikes us as reasonable, both because the outcome is likely to hang in the balance and given the very strong performance of markets over the past 12 months. At some point, we believe some consolidation is warranted.

Note: Post-election year = annual performance one-year post election; midterm = annual performance two years prior to election; pre-election year = annual performance one year prior. Sources: FactSet, S&P Global. Indexes are unmanaged and one cannot directly invest in them. They do not include fees, expenses or sales charges. Past performance is not an indicator or a guarantee of future results.

The bond market could do better, but that may have less to do with the election than the likelihood that receding inflation amid moderating growth may enable the Federal Reserve (Fed) to cut interest rates from mid-2024 onward. And we do not believe the Fed will be dissuaded from making the appropriate monetary policy decisions because of the election. The Fed retains its independence and will do what it feels is consistent with its mandate.

With the notion that there may be difficulty in garnering support for any substantive policy directives given the current environment and the shifting policy positions of each party, we think it would be more effective to focus on fundamentals around where we are in the economic and investment cycle. Our research shows that fixed income looks particularly attractive as interest-rate policy shifts away from a tightening bias. At the same time, many large-cap equities outside the “Magnificent Seven” (Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA and Tesla) are showing earnings expectations that exceed market averages at what we consider to be more attractive valuations. If there is one place to consider using the election results as a factor in security selection, sector bias may provide the most opportunity, in our view.

Stay the course amid political uncertainty

If you have any concerns about the market impact of the upcoming U.S. elections, reach out to your Ameriprise financial advisor. The investment portfolio you built with them is designed to withstand different market, economic and political cycles.