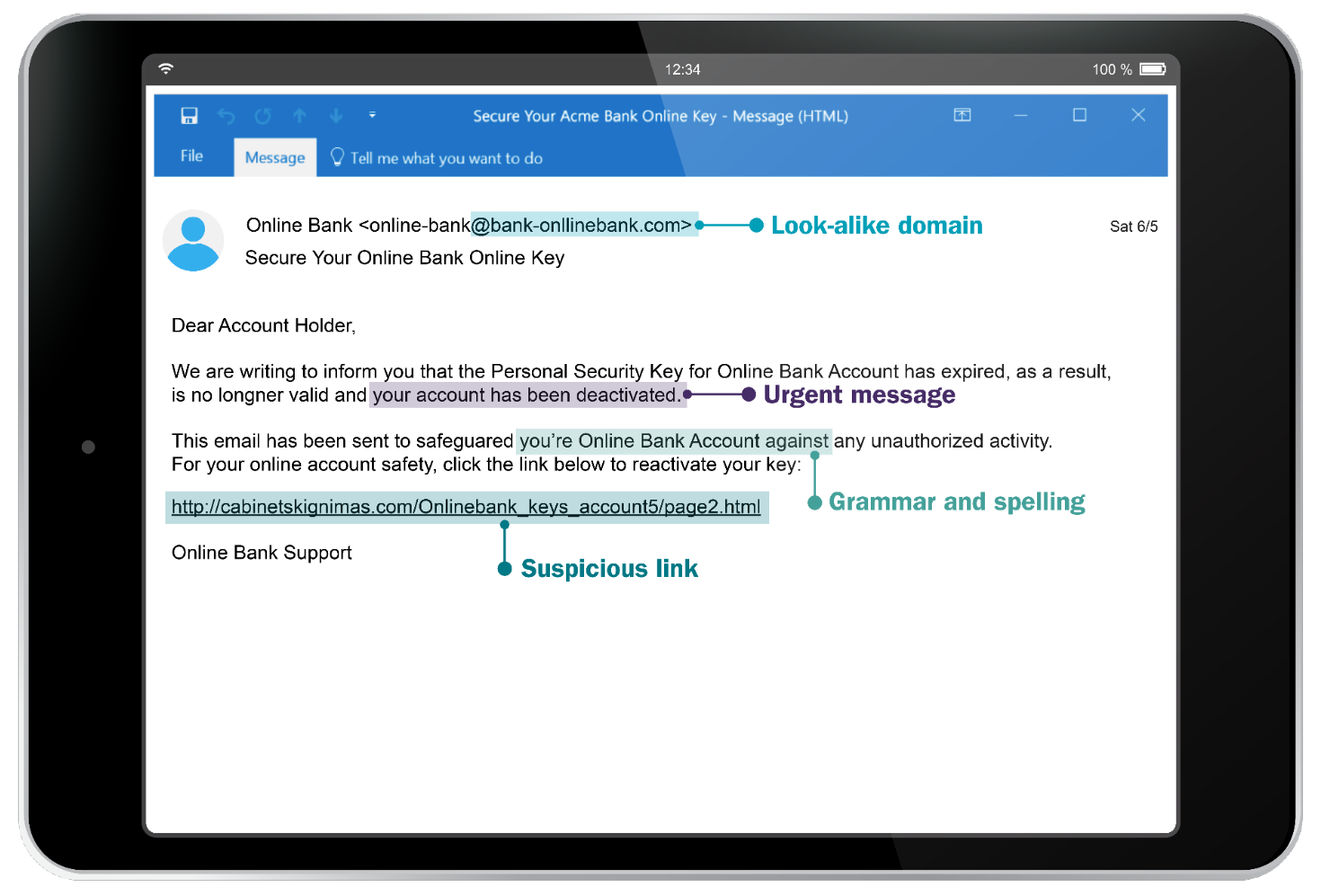

Email from Online Bank that uses a look-alike domain. Notice the urgent message, grammar and spelling mistakes, and suspicious link.

What to do if you suspect an email is a phishing scam

Do not click on any attachments or links in the email, or take any action requested within the message.

If the email is sent to a work account, follow their protocol for reporting phishing attempts.

- If the email is sent to a personal account, delete it and follow up with the purported sender directly. For example, if the sender appears to be a company, visit the company’s website directly to check on your account activity.

- Log in to accounts using 2-Step Verification when possible.

How to report email fraud or phishing to Ameriprise

If you suspect you’ve received a fraudulent email from someone posing as Ameriprise, please:

- Forward it to us immediately at: anti.fraud@ampf.com.

- Do not remove the original subject line or change the email in any way when forwarding.

- Watch for an auto-generated reply to let you know we’ve received your email. If we confirm the email is fraudulent, we will take appropriate action immediately.

- If you provided your account information to a request you suspect may have been fraudulent, call us immediately at 800.862.7919.

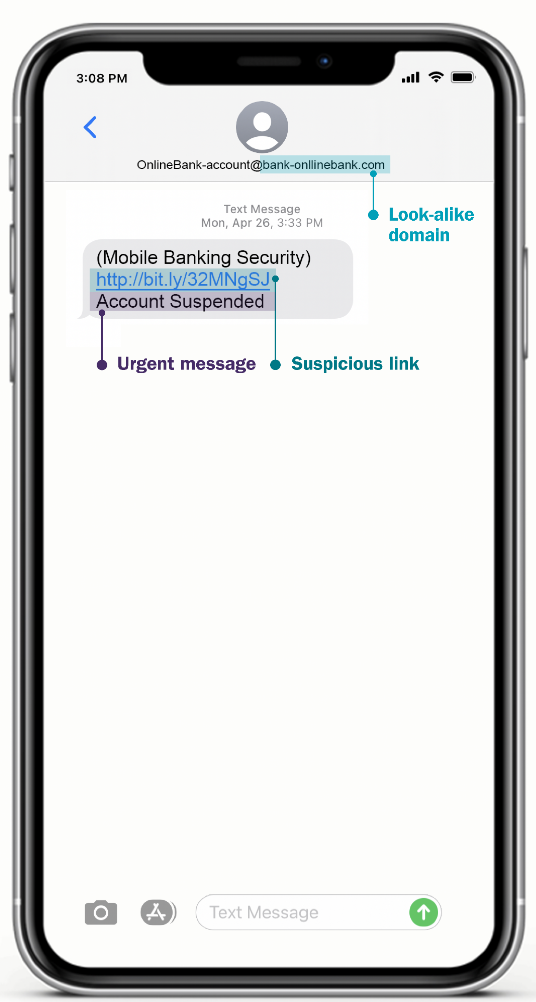

Text message phishing

Text message phishing – also known as “smishing” – refers to fraudulent messages sent via text or through other mobile-friendly communication platforms, such as Instagram direct messages, WhatsApp or your LinkedIn mailbox. Like email phishing, scammers conducting text phishing attacks aim to steal their victims’ personal and financial information.

How to spot text message phishing:

Fake email address. Most companies use a short code to send text alerts, not an email address. Emails may be from a look-alike domain and not a legitimate firm or company.

Suspicious links. The URL should include the company name and website domain (ameriprise.com, for example). Always be cautious of shortened URLs from services (bit.ly or tinyurl.com, for example).

- Urgent or threatening message. Messages are written to try to ‘bait’ you with an urgent situation that requires you to take immediate action. If the text contains a threatening message, it’s probably a scam.

Text message from Online Bank that uses a look-alike domain. Notice the suspicious link and urgent message.

What to do if you suspect a text phishing scam

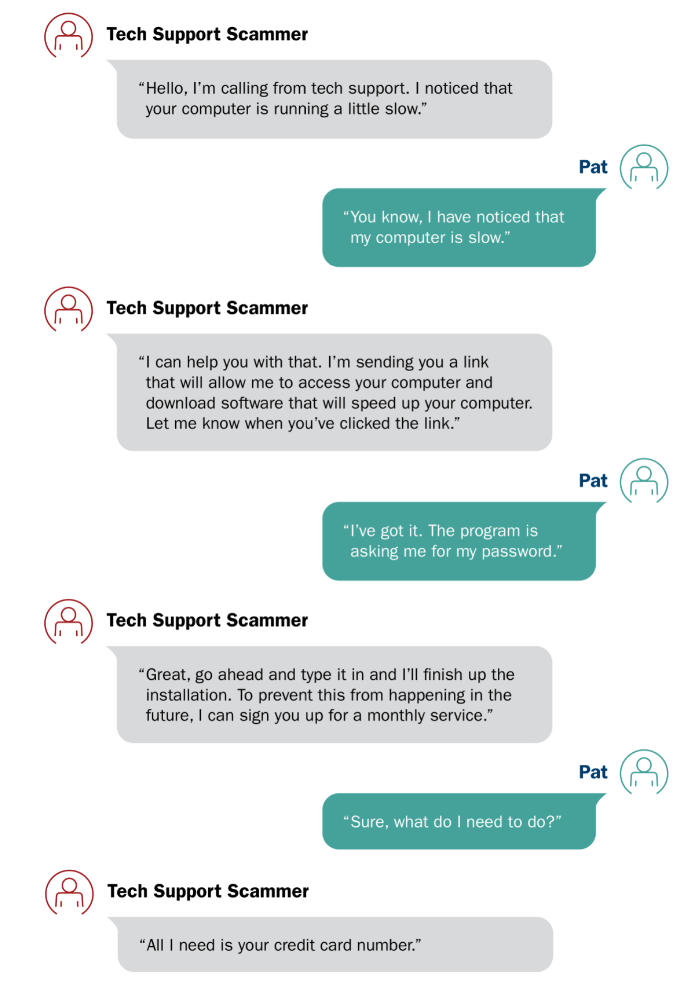

Voice call phishing

Voice call phishing (also known as “vishing”) is when a fraudster attempts to deceptively extract an individual’s personal or financial information through a phone call.

How to spot a voice phishing call:

Personal information requests. Ameriprise Financial, government agencies, and other bank and financial companies will not call you unexpectedly and ask you to provide personal information like passwords, account numbers, or Social Security numbers.

Remote access requests. Never give anyone remote access to your computer unless you have contacted them. Be wary of popups on your computer screen asking you to download software. Tech support from legitimate companies will not engage you this way.

‘Local’ phone numbers. Phone numbers can be spoofed. Be cautious of unfamiliar phone numbers even if they appear to be local.

- Sense of urgency. Like in the case of email or text phishing, vishing messages try to ‘bait’ you with an urgent situation requiring you to take immediate action.

Phone call exchange between an individual and tech support scammer. Notice the scammer prompts the individual to click on a suspicious link, insert their password, and provide their credit card number.

What to do if you suspect a phone call is a phishing scam

How to report fraud

If you suspect you’ve been a victim of one of these types of phishing scams, or have noticed unusual or unauthorized activity on your account, call us immediately and contact your Ameriprise financial advisor.

- Call 800.862.7919 and request to speak to a representative.

- Monday to Friday: 7 a.m. – 9 p.m. CT

- Saturday to Sunday: 7 a.m. – 7 p.m. CT

We’re committed to helping protect your information

At Ameriprise Financial, we’re committed to helping protect your online security. Our efforts are backed by our Online Security Guarantee, which covers 100% of the value of losses in your Ameriprise® account(s) due to unauthorized online activity, if we conclude that losses were incurred from your account through no fault of your own.

For more information about the steps you can take to help protect your account and personal information from the kinds of phishing scams listed above, review How you can protect yourself in the Ameriprise Financial Privacy, Security & Fraud Center.