When will the Federal Reserve cut policy rates? It's the question top of mind for all investors. And for those with a fixed income allocation, it’s a particularly time-sensitive one.

Like other asset classes, the direction of interest rates has a unique effect on how fixed income investments perform. But generally, the bond market is quicker to price in the likelihood of interest rate cuts — a move that historically has immediate implications for yields.

With that in mind, here’s where bond yields may be headed after the Fed begins lowering rates and why investors may want to consider a move to fixed income before then.

History doesn’t repeat, but it does rhyme

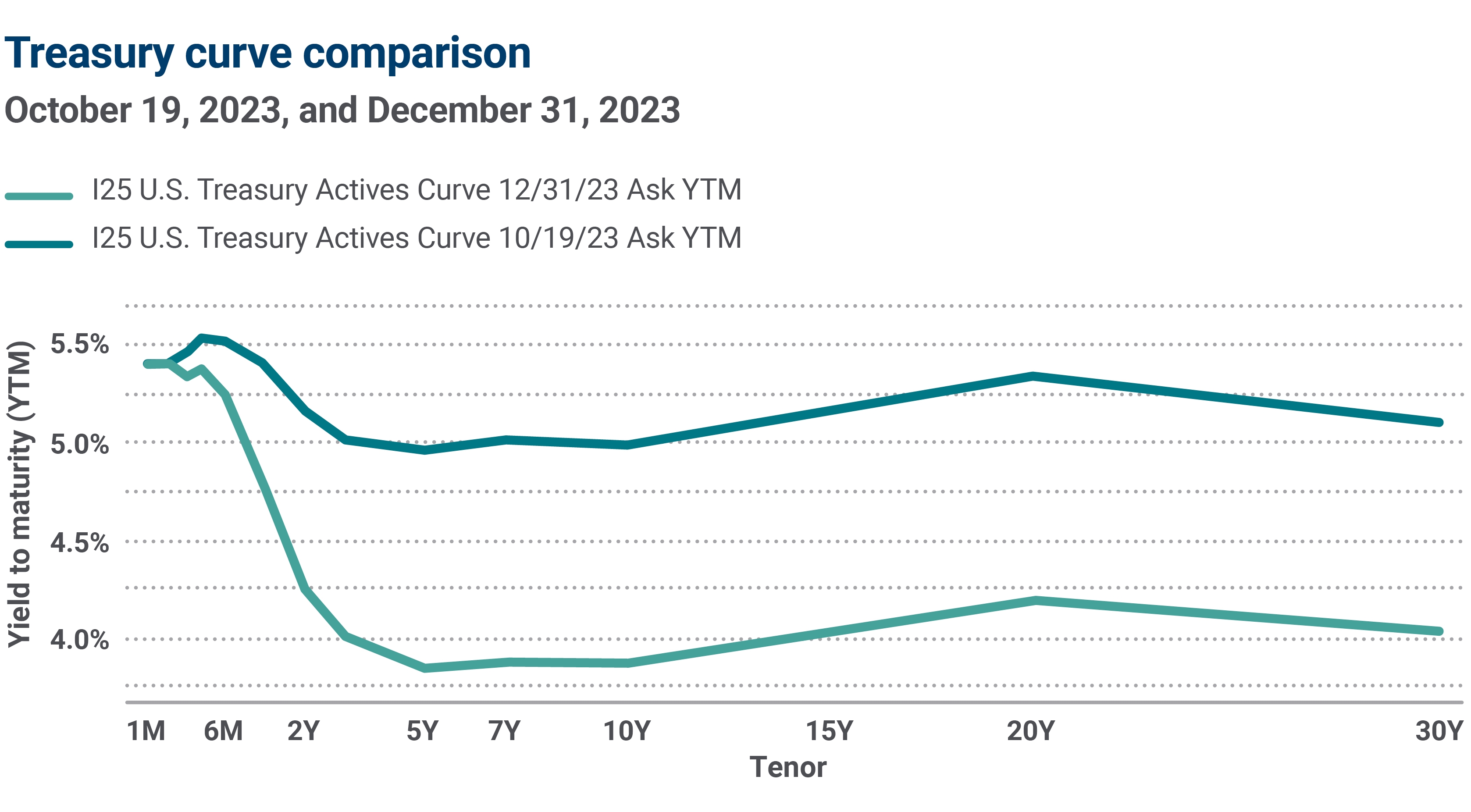

To make sense of where yields may be moving, let’s look at an example of how the bond market priced in prospects for Fed rate cuts in the fourth quarter of 2023. From October to December, markets priced in an entire percentage point of additional Fed policy rate reduction, which sent Treasury yields lower by about a percent for each maturity across the Treasury curve.

Source: Bloomberg L.P. This is shown for illustrative purposes only and is not guaranteed. Past performance is not a guarantee of future results.

Since the start of 2024, yields have reset higher, once again opening the door to a potential pricing in of future cuts. Once bond markets price where policy rates are headed in 2025, we anticipate yields to react in a manner similar to the fourth quarter of 2023.

Unlike cash investment yields that often track closely with each Fed cut, the bond market anticipates where rates are headed, more quickly pricing in future cuts. As a result, we believe intermediate bond yields are likely materially lower by the time cash investors notice their returns falling and consider where they might shift to. In our view, it may be the time to consider a shift into fixed income before the Fed cuts rates and bond markets price for more cuts next year.

Why have bond yields recently increased?

Find out why bond yields have gravitated higher this year and what this might mean for fixed income investors. (2:57)

What 2025 might look like

Two scenarios come to mind around where Fed policy rates might head next year:

- Soft landing: The future many investors envision is a soft landing where growth continues, and the Fed gradually lowers its policy rate back toward neutral. The expansion extends, and bond yields settle lower.

- Hard landing: A less likely alternative would be a modest recession that sees growth dip and a bolder policy response from the Fed. With inflation concerns eclipsed by the Fed’s mandate to maintain full employment, the Fed could lower its policy rate by several percentage points, leading intermediate-term government bond yields to gap lower as well. While cash investors would likely see yields fall away with rate cuts, bond investors could see healthy price returns.

Collectively, we view prospects for higher inflation and, thus, bond yields as a thing of the past for the current cycle. This suggests bond yields should ultimately settle lower — it’s more a matter of how far and how fast, in our view.

Generally, as bond yields fall, prices rise, adding to the total return performance. And for intermediate-term bonds, prices change more than they do on shorter-term fixed income given the same change in yield.

What rate cuts mean for investing and borrowing

- Cash investments: Fed rate cuts are directly linked to cash investment yields, with each reduction resulting in lower cash investment yields. For savers, Fed cuts may be disappointing.

- Fixed income investments: However, by the time the Fed makes its first cut, bond markets may have priced-in where Fed cuts are headed. As yields fall, bond prices rise, adding to coupon performance. In general, longer fixed-income investments are more sensitive to changes in yields, leading to larger price gains on bonds compared to cash investments. As a result, total return bond portfolios with intermediate-term investments may have the potential to outperform cash investments. It may be a good time for total return investors to consider investing in core fixed income, in our view.

- Floating-rate borrowing: Loans linked to prime or the secured overnight funding rate (SOFR) should see interest costs recede to a degree. For investors with existing floating-rate loans, lower rates offer a reprieve.

- Future fixed-rate borrowing: Consumers looking to finance a vehicle or home purchase may also benefit as a variety of consumer borrowing rates are linked to intermediate-term Treasury yields. So, as those yields settle somewhat lower, new auto loan and mortgage rates should make financing large purchases a bit easier to handle.

Bottom line

Once the Fed begins to lower policy rates, borrowing likely becomes more manageable for consumers. And while cash investment yields may fade, opportunities remain for investors shoring up fixed-income allocations today. Reach out to your Ameriprise financial advisor to put excess cash to work, and to help tune your bond and fixed income allocation for what may lie ahead.