Fixed income has long served as a cornerstone of investment portfolios, providing a reliable source of income, diversification and risk management. From the rise of bond funds and securitization in the 20th century to the expansion of private credit and structured finance following the global financial crisis (GFC), fixed-income markets have continuously evolved.

Understanding key milestones in this evolution can provide valuable insights into where the next opportunities may emerge.

Expansion and innovation beyond traditional instruments

Traditionally, bond markets were dominated by high-quality debt instruments, such as U.S. Treasuries and investment-grade corporate bonds, that provided a steady stream of income. By the 1980s, fixed-income markets had expanded to include broader access, alternative risk options and greater liquidity.

These included mortgage-backed securities, which enabled banks to bundle home loans into tradable investments. This innovation fueled a massive new market for real estate-backed debt, allowing financial institutions to offload mortgage risk while providing investors with exposure to the housing market. Around the same time, the high-yield (“junk”) bond boom took off, playing a crucial role in financing corporate takeovers and leveraged buyouts.

Over the subsequent decades, securitization extended into a wide range of consumer loans, including auto loans, student loans and credit card debt. As they grew in complexity, fixed-income markets forged a diverse ecosystem of structured products, credit derivatives and securitized loans. However, this growth also introduced systemic risks — many of which became painfully evident during the global financial crisis (GFC).

Reassessing fixed-income risk post global financial crisis (GFC)

The 2008 GFC was a watershed moment for fixed-income investing. The crisis exposed weaknesses in structured credit markets, particularly in subprime mortgage-backed securities. This led to an immediate collapse in liquidity, bank failures and government bailouts of major financial institutions.

In response, banks dramatically reduced their exposure to credit markets, and regulators introduced stricter capital requirements, most notably through the Dodd-Frank Act, to prevent excessive risk-taking. This forced a major restructuring of fixed-income markets and created a void in lending that soon became filled by alternative credit.

The rise of private credit and alternative fixed income

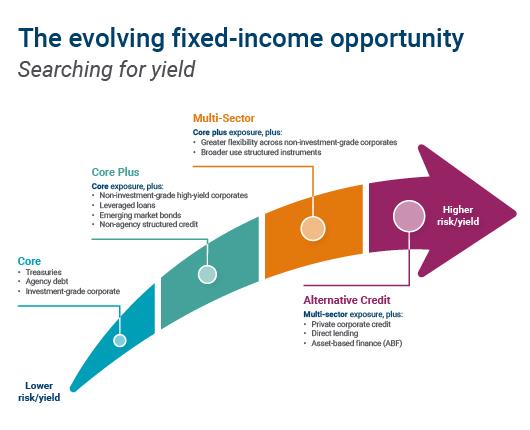

Fixed-income investing fundamentally changed in the post-GFC world, as traditional lenders scaled back and new players stepped in, leading to the rapid expansion of non-traditional fixed-income markets. Investors, facing a backdrop of near-zero interest rates, increasingly turned to these alternative credit strategies to enhance returns and improve portfolio diversification.

Investors began diversifying their fixed-income allocations through various strategies including multi-sector bond funds and non-traditional bonds. These gave investors better tools to earn income and manage risk in a persistently low-yield environment.

Perhaps the most notable development in this period was the rise of private credit as an asset class. Direct lending to middle-market companies surged, with private credit funds surpassing $1.5 trillion in assets in 2024.1

The landscape of fixed-income investing in the post-GFC world had fundamentally changed. It was no longer just about interest rate sensitivity and offsetting equity risk; investors began to actively pursue credit risk, illiquidity premiums and other sources of alpha to drive returns.

Accessing new opportunities with asset-based finance

While private credit has dominated the post-GFC alternative credit landscape, fixed-income markets continue to evolve in new and powerful ways.

One of the most significant ongoing trends in fixed income may be the continued expansion of structured credit markets — particularly asset-based finance (ABF). Unlike traditional private credit, which focuses on lending to companies, ABF involves financing real assets, such as residential mortgages, auto loans, equipment leasing and consumer credit. The market for ABF is an estimated $20 trillion, making it one of the largest and most untapped areas of fixed-income investing.

Broadly speaking, structured credit markets today are far more resilient than they were pre-GFC. Stronger regulatory oversight, improved underwriting standards and enhanced structural protections have made ABF significantly more transparent and resilient.

Source: Columbia Threadneedle Investments.

Staying ahead of fixed income’s evolution

Fixed-income markets have continuously evolved in response to innovation, regulatory changes and market demand, with ABF representing the newest potential opportunity for investors. In order to meet their long-term goals, investors should consult with their financial advisors to stay ahead of these changes and consider the next wave of opportunities in yield generation and risk management.

Discuss your investment strategy

To discuss how fixed income fits into your investment strategy and broader asset allocation to support your long-term financial goals, reach out to an Ameriprise financial advisor.