Anthony Saglimbene, Chief Market Strategist – Ameriprise Financial

This article is intended to provide perspective on how policy outcomes may impact financial markets, the economy and investments. These insights are not political statements from Ameriprise Financial.

Stocks, investors and humans all generally dislike uncertainty. Yet recently, the whirlwind of tariff announcements and changing specifics around the timing and what’s included in these actions have significantly increased the level of market uncertainty and investor anxiety.

In our view, the magnitude of these levies, the seemingly evolving objectives the White House is attempting to accomplish, and the still undetermined effects of tariffs on the U.S. economy and corporate profits have sapped stock momentum.

Markets have reacted unfavorably to tariffs so far

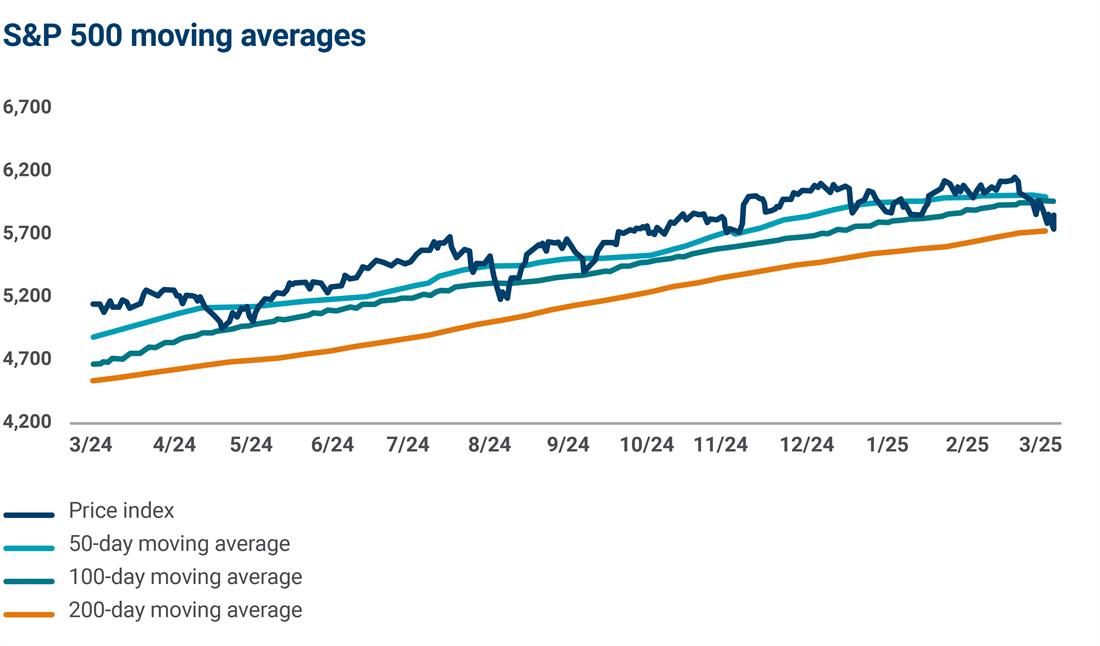

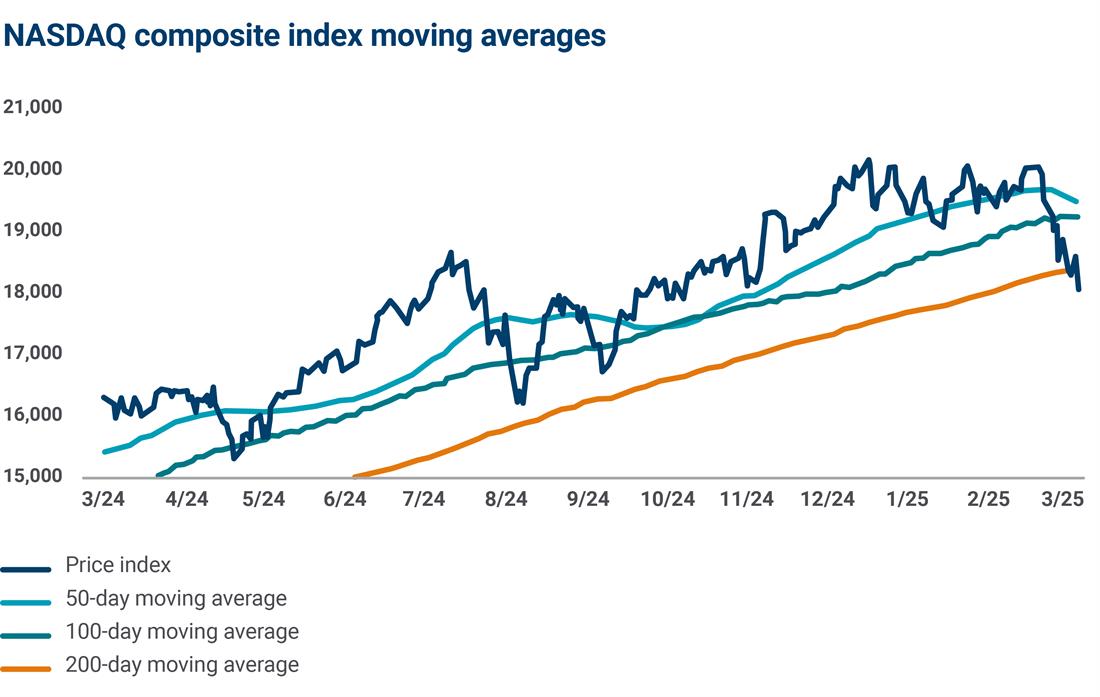

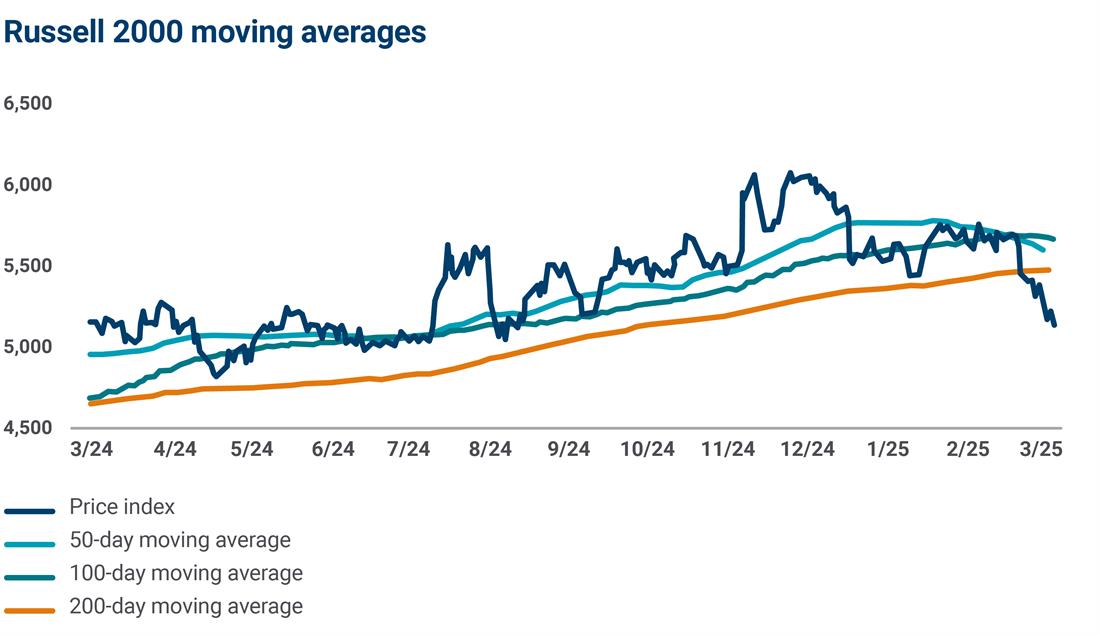

Notably, major U.S. stock averages are now lower since election day, with stocks significantly off their recent highs and trading below their near and longer-term trend lines.

Index Moving Averages are shown for illustrative purposes only and is not guaranteed. An index is a statistical composite that is not managed. It is not possible to invest directly in an index. Past performance is not a guarantee of future results.

Sources: FactSet, American Enterprise Investment Services, Inc. Data as of 3/6/2025

The White House tariff strategy is currently beginning to erode confidence in future growth, trade stability, sentiment and consumer/business spending outlooks which were forecasted to be relatively solid in 2025 — partly based on the prospects for increased fiscal tailwinds such as lower taxes and less regulation.

At least at present, the fiscal tailwinds investors assumed would help lift stocks this year have taken a back seat to aggressive tariff actions/announcements that are now weighing on equity prices. In addition, the day-to-day news from the White House around tariffs, including last-minute exemptions and new proclamations has clearly unnerved investors, weighed on stock prices and elevated volatility.

U.S. tariffs: Market and economic impacts explained

Uncertainty surrounding the implementation of U.S. tariffs is likely to be the big economic issue of 2025. Ameriprise Financial Chief Economist Russell Price provides his insights on the future of U.S. trade policy, as well as the potential economic and market impacts. (2:51)

Volatility may continue in the near-term

Unfortunately, we do not believe this environment is likely to change over the near-to-intermediate term, which could keep market volatility elevated. That said, stock prices follow expectations for profits over the next 12 months pretty closely over the long term. Analysts continue to see S&P 500 Index profits rising over the next 12 months.

If the factors discussed above do not meaningfully shift the earnings trajectory lower, we believe longer-term investors should look through these near-term bouts of equity volatility.

However, if earnings projections for the next four quarters begin to flatten or shift down, we believe stocks would likely see further selling pressure.

In this instance, stocks could face a more prolonged period of malaise, which would likely reflect less confidence in an expansionary environment for economic and profit growth this year. In our view, bonds, cash and alternatives may look attractive for new investments in this type of environment.

Learn more: Tariffs: What investors need to know

The outlook for corporate profit growth is not all bleak

It’s not clear yet where the profit trend is headed this year, and there is a risk that a prolonged period of disruptive tariffs could lower the profit outlook over the next 12 months.

Absent this factor, consumers are working and spending, which should benefit profit growth in 2025. Businesses are also spending, and CapEx plans across Tech/AI remain robust. And finally, for several S&P 500 sectors, year-over-year comparisons are easier, and share buybacks offer another lever to manage earnings per share (EPS) growth for cash-rich companies — absent an unexpected drop in demand. Despite the forming clouds, we believe it might be too early to sour on the outlook for corporate profits — or equity markets — this year.

How can investors navigate this period?

We believe keeping a close eye on S&P 500 profits can help investors filter out some of the noise currently coming from Washington.

For investors trying to navigate through the uncertainty, well-established portfolio diversification strategies, high-quality equities, cash, fixed income, alternatives, income-producing strategies, and real assets can all help mitigate risk and possibly provide a little ballast in a portfolio, should near-term equity pressure continue. And at some point, investors may want to consider using the dislocation in stocks to their benefit, either through dollar-cost averaging strategies or rebalancing efforts.

It’s a good time to have a candid conversation with your Ameriprise financial advisor about your current investments, allocation and risk tolerance. How would you feel if your portfolio dropped 5% or 10% from here? Is that an opportunity to invest more? And where would you invest? Or would such declines cause you concern or change your strategy? Your financial advisor can help answer these questions and structure a proactive approach to address current market volatility and keep your portfolio on track with your goals and objectives.

Discuss your investment strategy

Connect with your Ameriprise financial advisor to discuss your current risk tolerance, asset allocation and investment strategy to help weather unsettled market conditions and potentially take advantage of opportunities.