Last year, the Federal Reserve began cutting the federal funds rate — a move that signaled to investors that the long battle against inflation had been won.

You’d be forgiven if you thought the Fed’s move to slash its short-term policy rate would be followed by a corresponding fall in interest rates. Historically, rate-cutting cycles have been associated with lowered U.S. Treasury rates.

But not this time. Since that initial September cut, Treasury rates climbed steadily before a slight dip in February. So why are long-term rates still relatively high despite the Fed rate cuts? Several key factors have set this rate-cutting cycle apart from prior ones.

Factor #1: No economic crisis to avert

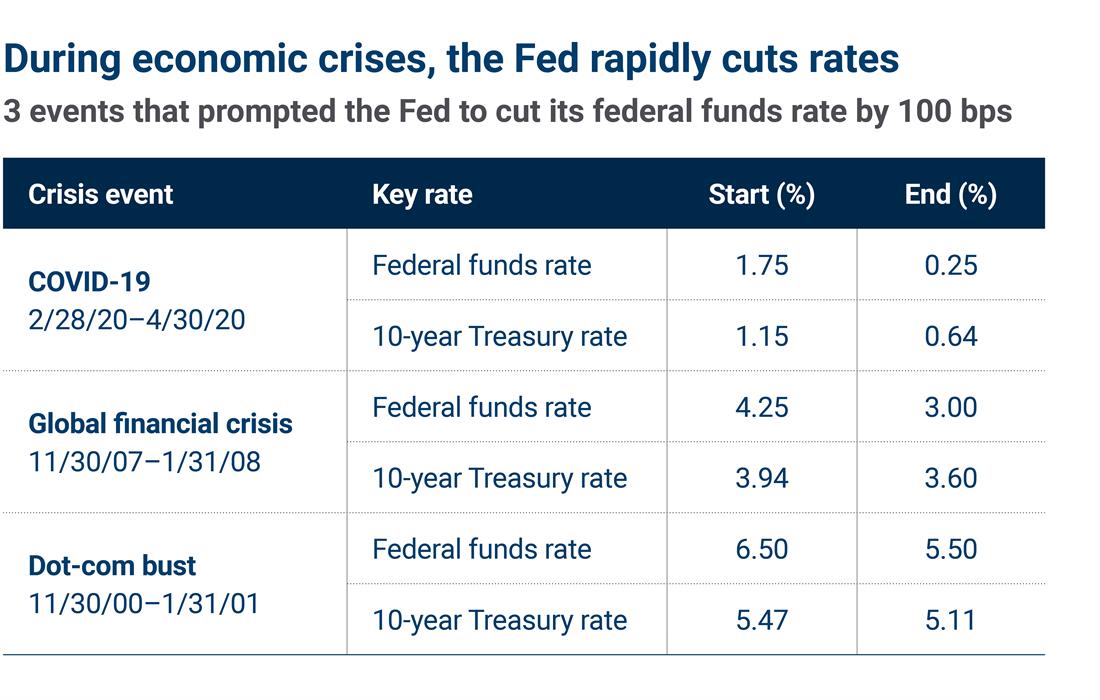

Historically, when the Fed has actively cut rates, it’s accompanied by a slowing economy or a crisis. Looking back at periods in which the Fed cut rates by 100 basis points (bps) in a three-month span, dire economic events were clearly guiding the Fed’s decisions. We’ve seen the Fed aggressively cut rates in response to COVID-19 (2020), the global financial crisis (2007-2008) and the dot-com Bust (2000–2001). While there are other instances of rate cuts in that 25-year span (the Fed cut 75 bps from July 2019 to January 2020), the pace of those cuts was gradual, and the Fed wasn’t necessarily attempting to prevent an economic disaster.

Source: Hartford Funds

Factor #2: Continued strong economic data

At the present time, the economy seems to be robust:

- 2.2 million jobs were created in 2024.1

- The January unemployment rate was 4.1% vs. longer-term averages closer to 6%.1

- Gross domestic product (GDP) growth was 2.8% for 2024, close to the 3% average since 2000.2

- Consumer spending is strong, with retail sales up 3.9% year-over-year in December.3

- Personal income grew by 4.8% year-over-year in December 2024.2

In our view, these numbers suggest no need for the Fed to cut rates and raise questions as to why the Fed should cut rates at all. Low unemployment, strong consumer spending and higher incomes are generally a recipe to keep rates higher or, at a minimum, at their current levels.

Factor #3: Inflation fears rekindling

The Fed has made tremendous strides in reining in inflation from its peak of 9.1% in June 2022 to 2.9% in December 2024.1 But as the saying goes, “the last mile is often the hardest.” We did see the Consumer Price Index (CPI)4 drop to a low of 2.4% in September before it ticked back up to 3% in January. Essentially, the CPI has been moving sideways to higher for a few months. And when you exclude food and energy costs, inflation has been stuck at 3.2–3.3% for the past seven months.

So, while we’re “stuck” at a higher level of inflation than the Fed and most Americans would like, there are new risks of a resurgence. Around the time U.S. Treasury rates bottomed in 2024, the U.S. presidential election came into focus. Investors came to realize that both parties would continue high levels of spending without cutting expenditures regardless of who won the election.

Ultimately, former president Donald Trump won the presidency, and the Republican party took both the Senate and the House. While the Republican margins are narrow, one-party control of both legislative houses makes it theoretically easier for the president to pass key parts of his agenda. Many of his pro-growth policies (deregulation, tax breaks) are intended to stimulate an already strong economy. In addition, the prospect of new tariffs, as well as proposals to expand the deportation of immigrants, have many investors worried about a resurgence of inflation.

Finally, many new policy proposals could directly impact the U.S. debt balance, which stood at $35.5 trillion.5 Estimates of future debt levels range from an additional $3 to $7 trillion over the next few years, in the absence of drastic changes to spending — which may significantly raise the price the U.S. government has to pay on newly issued debt.

The extent and outcomes of any policies won’t be fully known for some time. Nevertheless, the market is trying to project a range of outcomes and, as a result, 10-year Treasuries rose 30 bps since the election through year-end and have ranged from 4.43% to 4.79% this year.

Why cut rates at all?

These three factors — the lack of a crisis, a strong economy and sticky inflation — have raised the inevitable questions for many investors: Why did the Fed start cutting rates in the first place? And are rate cuts even needed in 2025?

Investors should keep in mind that the Fed’s recent hiking cycle took place with unprecedented speed to tame inflation. The federal funds rate went from 0% to 5.50% in the span of 18 months — the fastest upward move since the 1980s. As the inflation rate gradually declined toward its target rate of 2%, the Fed remained cautiously aware of the risk of staying overly restrictive for too long.

Keeping its dual mandate of price stability and full employment in mind, Fed policymakers were comfortable taking their foot off the gas last September when they saw weakness in labor markets. But after a 100-bp rate cut between September and December of 2024, Fed policymakers have signaled an awareness of the risks that inflation could reignite. It’s no surprise that the rate-cutting cycle is on hold for the time being.

Bottom line

In our view, the Fed’s recent cutting cycle could be viewed from the lens of an aggressive Fed downshifting to a more “neutral” policy. Many investors have been left scratching their heads about rates going higher following the Fed cuts, but in light of the three aforementioned factors, a higher-rate environment makes sense.

How may changing rates affect your portfolio?

If you’re concerned about how the Federal Reserve’s policy decisions may affect your portfolio, reach out to your Ameriprise financial advisor. They can help you make sense of the impact and position your portfolio for a changing rate environment.