Balance your desire to grow your investments and reduce risk by embracing these foundational investing concepts.

Asset allocation and diversification are two of the most important concepts to understand when building a personalized investment strategy. Working together, these two principles can help grow your investment portfolio, while also helping to hedge the potential for losses.

However, incorporating these principles into your portfolio is not a one-size-fits-all undertaking. We can work with you to create an investment strategy that’s properly allocated and diversified to fit your personal financial goals, risk tolerance and time horizon.

Here’s why an investor should consider diversification and asset allocation:

In this article:

- What is asset allocation? What is diversification?

- Why are asset allocation and diversification important?

- Which factors should an asset allocation and diversification strategy consider?

- How often should I review my asset allocation and diversification?

- Questions to discuss with us

What is asset allocation? What is diversification?

Although the terms “asset allocation” and “diversification” are often used interchangeably, they are different but related concepts:

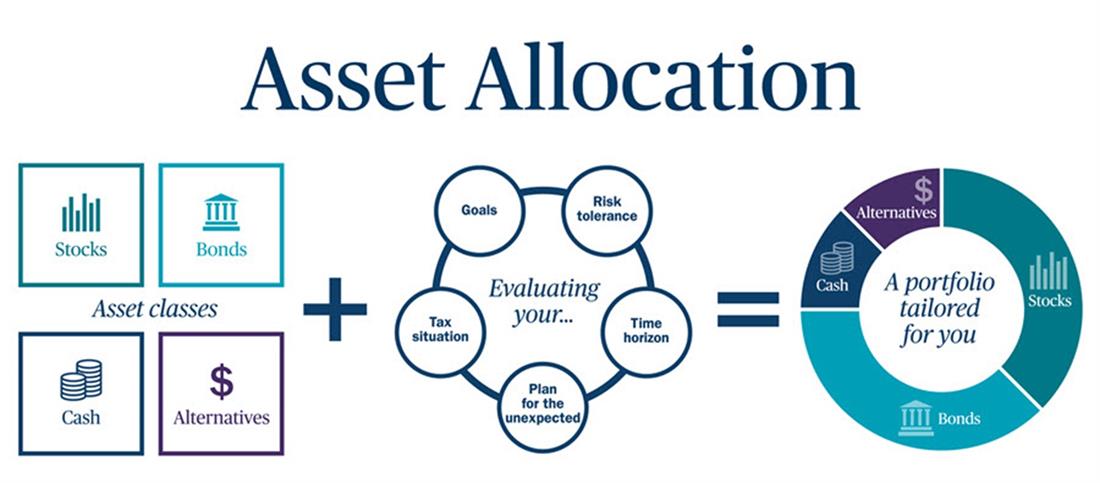

- Asset allocation refers to the percentage of different types of assets — stocks, bonds, cash and alternative investments — in your portfolio. By spreading your investment dollars across different asset classes, you can potentially reduce risk while building a portfolio that reflects your goals, needs and time horizon.

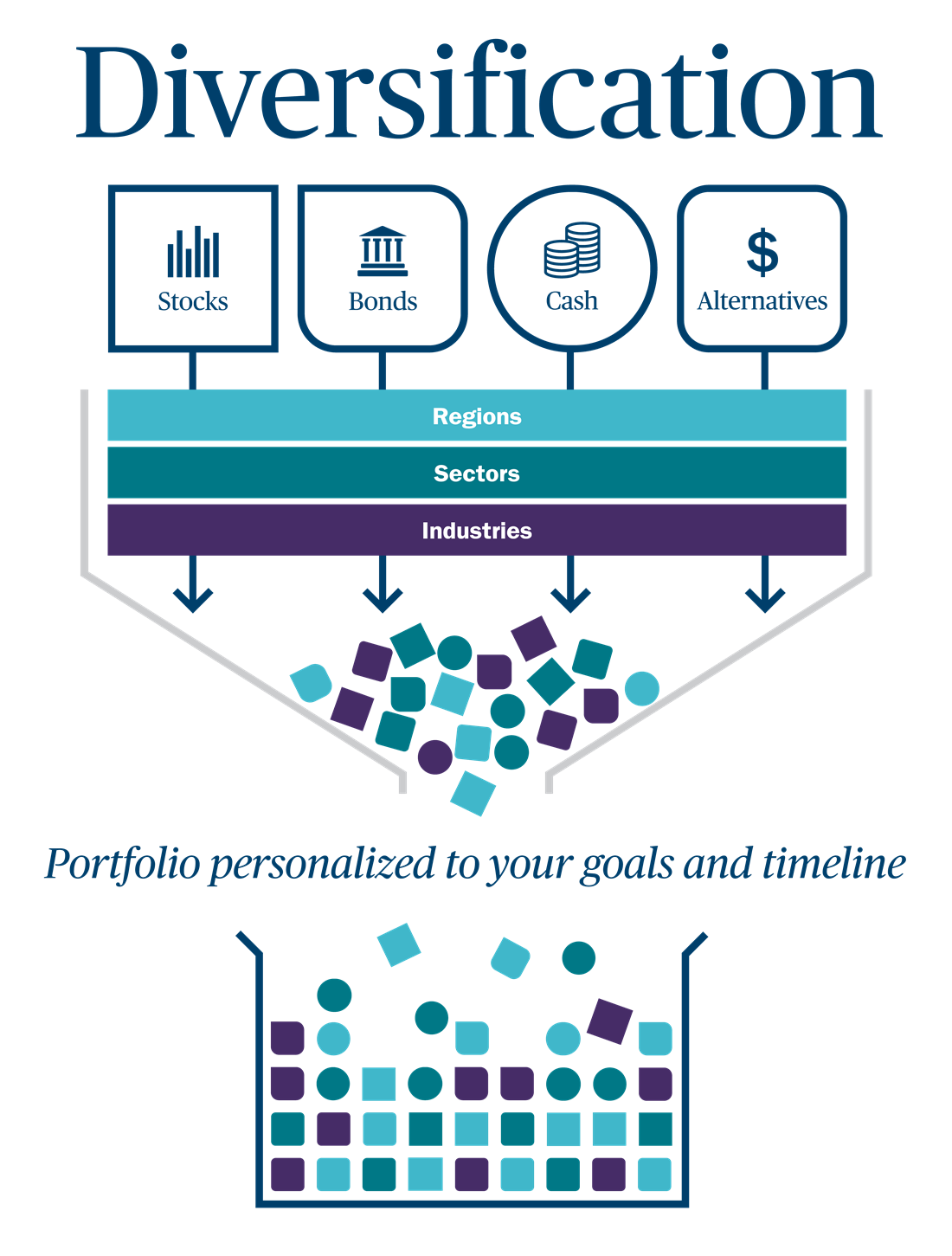

- Diversification is the process of selecting a variety of investments within the various asset classes included in your portfolio. Instead of relying on one stock or bond — or even one type of stock or bond — a diversified portfolio invests in many types of stocks and many types of bonds. For example, this could mean acquiring both corporate and municipal bonds, and buying a multitude of stocks from large-, small- and mid-sized companies that operate within various industries and serve different regional markets. Overall, the objective of diversification is to help contain risk and reduce the potential impact of major market swings.

Learn more: Asset classes: The building blocks of an investment portfolio

Why are asset allocation and diversification important?

Asset allocation and diversification are critical elements of sound investing for a simple reason: Generally, different asset classes respond to markets differently. When one is up, another might be down. That means that having a broad range of investments can help lessen the impact that any single economic or market event may have on your portfolio.

And while having a diversification and asset allocation strategy does not guarantee your portfolio will grow or be protected against a loss, having your investments allocated according to your specific needs can make sure the balance of risk and return is right for you.

Which factors should an asset allocation and diversification strategy consider?

Asset allocation and diversification doesn’t mean simply divvying up your investments into equal slices. Depending on your situation, some asset classes will get more of your investment dollars and others less. We will consider the following factors when creating a personalized asset allocation and diversification strategy for you:

Goals: Most people save and invest with specific short- and long-term goals in mind, each often with their own timeline. A primary goal is often retirement, but you likely have other major financial goals, including buying a home or paying for your children’s education, that, together, will help shape your asset allocation strategy.

Time horizon: Your time horizon is the amount of time you need to meet a financial goal. If your goal is retirement or paying for a loved one’s education, your time horizon could be years or even decades. In contrast, if your goal is paying for a wedding, your time horizon could be just a few years.

Risk tolerance: Risk tolerance is about having a realistic understanding of your ability and willingness to tolerate fluctuations in the value of your investments. Determining whether you’re a conservative, moderate or aggressive investor — or something in between — will also influence determining the right asset allocation strategy for you. It will likely change over time and should be revisited regularly, especially as your goal timeline nears. For example, the longer the time horizon, the more aggressive you can be with your investments. The shorter the time horizon, the more conservative you may want to be.

How often should I review my asset allocation and diversification?

Because different types of asset classes typically grow at different rates, the risk profile of your investment portfolio can, over time, naturally drift away from the initial asset allocation and diversification targets that you created with my team. As such, plan to regularly review your portfolio to make sure it’s still in line with your risk tolerance and time horizon. If during one of these reviews, your asset allocation and diversification has evolved substantially, then your portfolio will need to be rebalanced to bring it back to your original targets.

Learn more: Why rebalancing your portfolio regularly is important

We can help you manage risk

While the concepts of asset allocation and diversification are simple, the execution can be complicated. We can work with you to create an asset allocation and diversification strategy that’s tailored to your specific goals, time horizon and risk tolerance.