Discover your risk tolerance and how it may inform your portfolio’s investment strategy.

Whether you're just starting to invest or have years of experience, understanding your risk tolerance — your willingness to tolerate fluctuations in the value of your assets — is a foundational component of investing.

We can help you understand the role your personal risk tolerance plays in creating an investment strategy that works for you and your financial goals.

As a first step, here’s how to determine your risk tolerance in investing:

In this article:

What is risk tolerance?

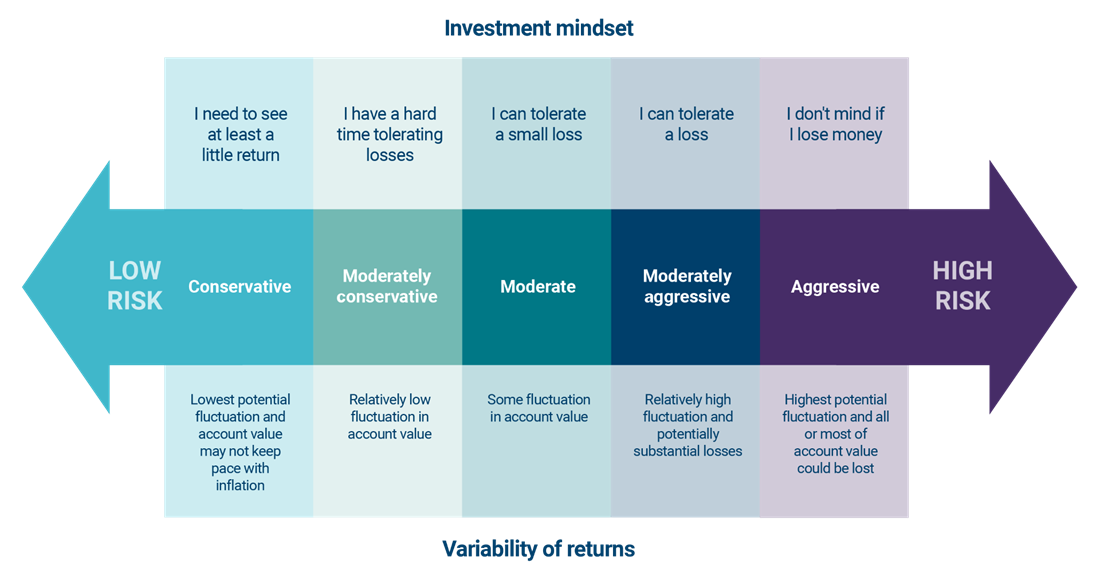

Risk tolerance is the level of unpredictability, volatility and losses you’re willing to accept as an investor to achieve a particular investment return. In short, it’s how you feel about investment gains and losses, opportunities and setbacks. Generally, risk tolerance is measured on a spectrum that ranges from aggressive to conservative:

- Aggressive: You are seeking the highest return and are willing to accept the highest fluctuation, knowing you could lose most or all of the value of your account.

- Moderately aggressive: You are seeking a relatively high return and are willing to accept a relatively high fluctuation and potentially substantial loss in your account value.

- Moderate: You are willing to accept a moderate return in exchange for some fluctuation in account value.

- Moderately conservative: You are willing to accept a relatively low return in exchange for a relatively low fluctuation in account value.

- Conservative: You are willing to accept the lowest return in exchange for the lowest potential fluctuation in your account value, even if it may not keep pace with inflation.

Learn more: Aligning investments with your financial goals

How to determine your risk tolerance in investing

Being able to accurately gauge risk tolerance can be difficult, as only you can decide how comfortable you are with the tradeoff between higher risks and the potential for higher returns. However, this information typically helps form the foundation of your investment strategy.

Take our risk tolerance quiz

You can determine your risk tolerance for investing by answering a few questions.

Take the quiz

Why knowing your risk tolerance is important

Along with your financial situation and time horizon, your risk tolerance plays a crucial role in finding the right investment strategy for you. Here’s why it’s so important:

- It’s an indicator of which investments are appropriate for you. Different investments carry different degrees of risk. For example, an individual stock has a much higher risk profile and return potential than a U.S. Treasury bond, which has a lower return potential, but is generally considered to be a relatively “safe” investment. Your tolerance for risk will help determine what kinds of investments you are comfortable with buying and holding in your portfolio.

- It is foundational to your asset allocation and diversification strategy. Your risk tolerance is a key input when creating a personalized asset allocation and diversification strategy for your investment portfolio. The goal of an asset allocation and diversification strategy is to spread your investment dollars across a variety of different asset classes and investment types in a manner that balances your desire to mitigate risk with your long-term objectives of investment growth.

- It helps you stay invested over the long term. If you lose your confidence and sell investments during a down market, you could miss an eventual recovery in prices. Knowing your risk tolerance can help you avoid that mistake. That’s because when you know your investments are aligned with your personal risk profile, it’s easier to navigate periods of market volatility and stay the course.

Learn more: Why should an investor consider diversification and asset allocation?

What kinds of risks are there?

As you think about your risk tolerance, it’s important understand common risks you may face as you build and maintain your portfolio:

- Investment risk refers to the uncertainty involved in any investment decision. When you invest your money, you can never know for sure if the investment’s actual returns will differ from the expected returns.

- Inflationary risk (also known as purchasing power risk) refers to the possibility that rising prices associated with inflation could outpace your investment returns, meaning your portfolio must work harder to help you maintain the same levels of purchasing power.

- Liquidity risk refers to the possibility that you won’t be able to get your money out of an investment when you need it or that you’ll have to sell an investment at a loss to get access to the funds you need.

- Reinvestment risk refers to the possibility — commonly found in bond investing — that you won’t be able to reinvest proceeds from an investment at a rate comparable to the original investment’s rate of return.

- Exchange rate risk (also known as foreign exchange risk) refers to risk involved with foreign investments due to fluctuations in the U.S. dollar compared to the foreign-investment currency.

Get advice tailored to your risk tolerance

We can help align your personalized investment strategy to your risk tolerance and help you reach your financial goals.